Texas’s School Funding Scandal: Why Ditching Property Taxes for 100% State Cash Is a Game-Changer

Opinion / Advocacy – Texas boasts one of the largest public education systems in the nation, serving over 5.5 million students across more than 1,200 school districts. Yet, the way we fund our K-12 schools remains a patchwork of state contributions and local property taxes—a dual mechanism that perpetuates inequities, burdens homeowners, and complicates accountability. As we navigate fiscal year 2025, with state coffers bolstered by economic growth, it’s time to advocate for a bold reform: eliminating school property taxes entirely and providing 100% of K-12 funding through state sources. This shift would promote fairness, streamline administration, and ensure every Texas child has access to quality education regardless of their zip code.

The Dual Funding Mechanism: A System Ripe for Reform

Texas’s K-12 funding operates under a dual structure, blending state and local revenues to meet the constitutional mandate for a “general diffusion of knowledge.” At its core is the Foundation School Program (FSP), which calculates a baseline funding level per student and divides the responsibility between the state and local districts.

- State Share: The state provides funding through formulas that account for student needs, such as special education or economically disadvantaged populations. This includes “Tier 1” funding for basic allotments and “Tier 2” for enrichment. The state aims to equalize funding by reducing aid to wealthier districts and recapturing excess local revenue—often called the “Robin Hood” system—to redistribute to poorer ones.

- Local Share: School districts levy property taxes on residential and commercial properties within their boundaries to cover the remainder. These taxes fund operations, maintenance, and sometimes debt for facilities. Local contributions typically make up 50-60% of total K-12 funding, with the state covering the balance plus federal aid (around 10-18%). This local reliance creates disparities: Wealthy districts with high property values generate more revenue at lower tax rates, while property-poor districts struggle even with higher rates.

This dual approach, rooted in laws like Chapter 48 of the Texas Education Code, was designed to balance local control with state oversight. However, it has led to persistent inequities. In FY 2025, the average funding per student is approximately $15,503, covering teacher salaries, student services, and operations. But this figure masks wide variations—some districts receive far more due to robust local tax bases, while others rely heavily on state aid amid rising property values that outpace homeowner incomes.

Critics argue the system is outdated, especially with Texas’s booming population and economy. The “Robin Hood” recapture mechanism alone is projected to collect nearly $5 billion from districts in 2025, redistributing it statewide. While intended to promote equity, it often feels punitive to growing suburbs and fails to fully address underfunded rural or urban schools.

State-Administered Programs: The Backbone of Current Funding

Drawing from the Texas Education Compensation 2025 spreadsheet—a detailed ledger of state appropriations—the state’s role in K-12 funding is substantial, totaling an estimated $38.4 billion in FY 2025. These funds are administered primarily through the Texas Education Agency (TEA) and flow via targeted programs. Here’s a breakdown of key state-administered initiatives based on the data:

- School Apportionment – Foundation Program (Object Code 7602): The largest slice at approximately $30.1 billion, this is the core of the FSP. It includes $26.98 billion from the Foundation School Fund and $3.11 billion from the Available School Fund, ensuring baseline per-student allotments adjusted for district needs.

- Grants to Elementary and Secondary Schools (Object Code 7601): Around $7.9 billion, encompassing federal pass-throughs like $3.84 billion from Health/Ed/Welfare funds (e.g., Title I for low-income students) and $2.81 billion from the Federal School Lunch program. State contributions add $745 million from general revenue and $397 million from instructional materials funds.

- Payments/Grants to Counties and Other Political Subdivisions (Object Codes 7612/7613): About $434 million, including $168.5 million in federal grants to subdivisions and $194.5 million in state general revenue for various local supports, such as compensatory education.

- Grants – Community Service Programs (Object Code 7623): $43.97 million from TEA’s general revenue, supporting extracurricular and community-based initiatives.

These programs highlight the state’s commitment, but they only tell half the story. The spreadsheet excludes local revenues, focusing solely on state and federal disbursements.

The Hidden Burden: Local Property Taxes Fill the Gaps

While the state provides a significant portion, local property taxes shoulder 50-60% of the load—estimated at $30-35 billion annually in recent years. In FY 2023, total property tax collections statewide exceeded $81.4 billion, with nearly half ($39.5 billion) going to school districts. Projections for FY 2025 suggest similar or higher figures, driven by rising property values despite recent relief efforts. For instance, the TEA reports that combined state and local FSP revenue per student reached $13,405 in FY 2025, up 49% from 2014, with locals contributing heavily.

This reliance on property taxes exacerbates issues: Homeowners in high-value areas face skyrocketing bills, while commercial properties often benefit from abatements. In 2025, despite $51 billion allocated for property tax cuts over two years—including $17.5 billion for rate compression and increased homestead exemptions—local taxes remain a core funding source. These measures provide partial relief, such as raising senior exemptions to $200,000 (effectively eliminating school taxes for many elderly Texans), but fall short of systemic change.

The Case for 100% State Funding: Equity, Efficiency, and Economic Sense

It’s time to eliminate school property taxes and fund K-12 entirely through state sources. Texas has the resources: Lawmakers entered the 2025 session with at least $21 billion in available general revenue and $23 billion in the Economic Stabilization Fund. Shifting the full burden to the state—potentially via sales taxes, severance taxes on energy, or reallocating surplus—would yield transformative benefits:

- Promoting Equity: Ending local taxes would dismantle disparities tied to property wealth. No more “Robin Hood” recapture draining billions from districts; instead, a uniform state formula ensures consistent funding statewide.

- Relieving Homeowners: Property taxes are regressive, hitting fixed-income families hardest. Full elimination could save the average homeowner thousands annually, boosting economic mobility and homeownership.

- Simplifying Administration: Districts could focus on education rather than tax collection. The state already handles major programs efficiently—expanding this to 100% would reduce bureaucratic overlap.

- Investing in the Future: With a $10 billion funding boost in 2025 (including a $55 per-student increase), Texas schools are improving, but tying it to property relief would amplify impact. Proposals like House Bill 9 (exempting business personal property) and constitutional amendments for higher exemptions show momentum toward relief—why not go further?

Critics may cite costs, but with projections of sustained revenue growth, Texas can afford it. States like Vermont and Hawaii have minimized local taxes for schools with positive results. In Texas, this reform would honor our commitment to education while unburdening taxpayers.

Conclusion: A Call to Action for 100% State-Funded Schools

Texas’s dual funding model has served its purpose, but in 2025, it’s clear we can do better. By leveraging the state’s robust programs and surplus, eliminating school property taxes is not just feasible—it’s essential for a fairer, more efficient system. Lawmakers should prioritize this in future sessions, ensuring every student’s potential isn’t limited by local tax rolls. The future of Texas education depends on it.

Fate, TX

CyberSquatting City Hall: How City Claimed a Developer’s Domain

How Fate registered a developer’s project domain after seeing it in official plans, then fought to keep that fact hidden

FATE, TX – Cities are expected to regulate development, not steal its name.

Records obtained by Pipkins Reports show the City of Fate registered the domain name of a private development, lafayettecrossing.com, while actively working with the developer who had already claimed that name in official plans. The move, made quietly during a heated approval process, raises serious questions about whether Fate’s city government crossed from partner to predator, taking digital ownership of a project it was supposed to oversee with neutrality and good faith… and depriving the developer of their rights to domain ownership.

What followed, attempts to conceal the purchase, shifting explanations from city officials, and a documented pattern of advocacy on behalf of the developer, suggests the domain registration was not an accident, but part of a broader effort to control the narrative around one of the most divisive projects in the city’s history.

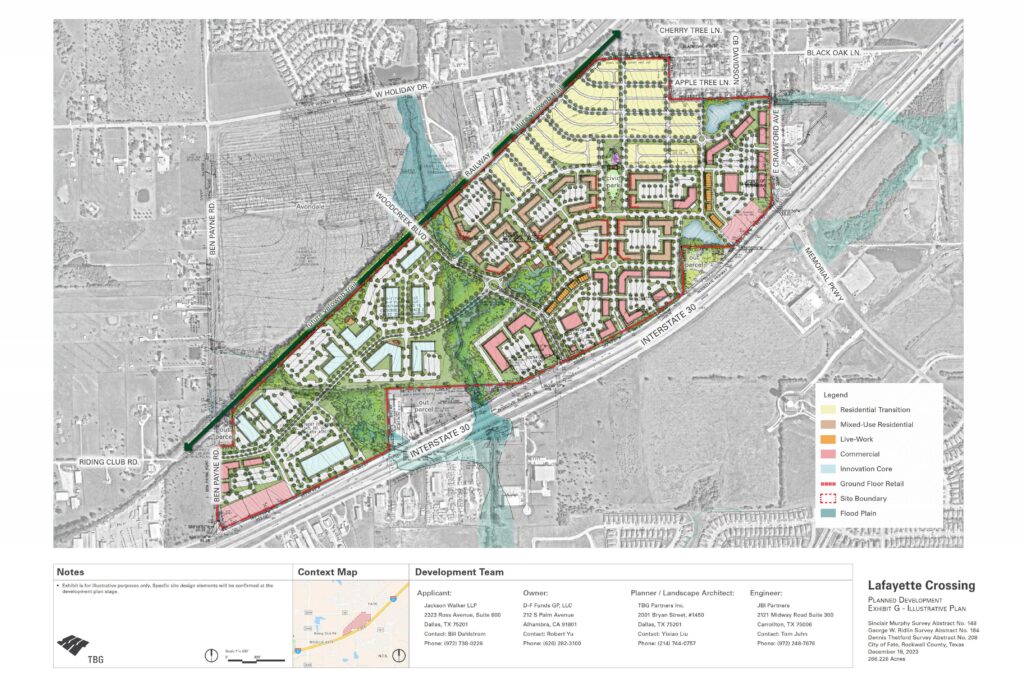

A site plan submitted by the developer, D-F Funds GP, LLC, led by Robert Yu, shows the project title “Lafayette Crossing” clearly identified in the title block on December 20, 2023. The document was part of the city’s official development review for the controversial project at the corner of I-30 and Highway 551.

Less than two months later, on February 7, 2024, the City of Fate registered the domain lafayettecrossing.com, Invoice #116953461, for $12.

Domain records confirm the registration date, with the domain set to expire on February 7, 2027. By that point, Lafayette Crossing was already the established name of the project, used by the developer and embedded in official plans circulating within City Hall.

This was not a coincidence. The city had the plans from the developer. Their were extensive talks regarding the project. Then the city registered the domain without the knowledge of the developer. This is known in the industry as, “Cybersquatting.”

The development, originally referred to as the “Yu Tract,” became known as Lafayette Crossing as it moved through the approval process. The project ignited intense public opposition over density, traffic congestion, infrastructure strain, and the long-term direction of Fate’s growth. Despite sustained resistance and packed council chambers, the city council approved the project.

The political fallout was severe. In the elections that followed, four council members and the mayor were replaced, an extraordinary level of turnover that reflected deep voter dissatisfaction. Two members from that Council, Councilman Mark Harper and Councilman Scott Kelley, remain, but are up for reelection this May.

That context matters, because the domain registration did not occur in isolation. It occurred amid a broader, documented pattern of city officials actively working to shape public perception in favor of the developer.

In February 2024, Pipkins Reports, then operating as the Fate Tribune, published an exposé based on internal city emails showing City Manager Michael Kovacs discussing strategies to “educate” the public about Lafayette Crossing. In those emails, Kovacs suggested deploying what he referred to as “Fire Support,” a term used to describe both paid and unpaid advocates brought forward to counter citizen opposition and astroturf public support for the project.

That reporting revealed a city government not merely responding to public concerns, but actively attempting to manage and counter them.

In a later publication, Pipkins Reports (Fate Tribune) documented the City of Fate’s hiring of Ryan Breckenridge of BRK Partners, engaging in what records showed to be a coordinated public relations effort aimed at improving the project’s image and swaying public sentiment. The campaign was presented as informational, but residents viewed it as advocacy on behalf of the developer, funded with public resources.

It was within this environment, where city staff had already aligned themselves publicly and privately with the developer’s interests, that the city registered the lafayettecrossing.com domain. Yet that fact remained hidden until PipkinsReports.com submitted an Open Records Request on September 30, 2025, seeking a list of all domains owned by the city.

Rather than comply, the City of Fate objected. On October 14, 2025, officials asked the Texas Attorney General’s Office for permission to withhold the records, citing “cybersecurity” concerns.

On January 6, 2026, the Attorney General rejected that claim and ordered the information released. The city complied on January 20, 2026.

In addition to the lafayettecrossing.com domain, the records revealed the city owns numerous domains tied to redevelopment and branding initiatives, including:

- FateTX.gov

- DowntownFate.com

- FateFoodHaul.com

- FateMainStreet.com

- FateStationHub.com

- FateStationMarket.com

- FateStationPark.com

- FateStationSpur.com

- OldTownFate.com

- TheHubAtFateStation.com

- TheSpurAtFateStation.com

- ForwardFate.com

Most clearly relate to city-led initiatives. LafayetteCrossing.com stands apart because it mirrors the established name of a private development already proposed, named, and publicly debated.

When questioned via email, Assistant City Manager Steven Downs initially suggested the domain purchase occurred long before his involvement and downplayed any potential issues. When we revealed documents to show Downs was actively engaged with the project at the same time the Lafayette Crossing name entered the city’s official workflow, his story changed.

In follow-up correspondence, Downs acknowledged he was aware of the project name, while placing responsibility for the domain purchase on former Assistant City Manager Justin Weiss. Downs stated he did not know whether the developer was aware of the purchase and said he was not concerned about potential liability.

What remains unexplained is why the city registered the domain at all, knowing it belonged to a private project, and why it attempted to keep that information from the public.

Opinion

Viewed in isolation, a $12 domain purchase might seem trivial. Viewed in context, it is not.

When a city that has already worked to astroturf support, hire public relations firms, and counter citizen opposition also quietly registers a developer’s project domain, then attempts to conceal that information from the public, the line between regulator and advocate disappears.

The question is no longer whether the city knew the name. The record shows it did.

The question is why a city government so deeply invested in selling a controversial project to its residents felt the need to take ownership of the project’s digital identity as well.

Control of messaging, control of perception, and control of narrative are powerful tools. Sometimes it is equally as important to control what is not said.

Election

New Poll Shows Crockett, Paxton Leading Texas Senate Primary Contests

Texas Senate Primaries Show Early Leads for Crockett and Paxton

AUSTIN, Texas – A new poll released by The Texas Tribune indicates that Jasmine Crockett and Ken Paxton are leading their respective primary races for the U.S. Senate seat in Texas. The survey, published on February 9, 2026, highlights the early momentum for both candidates as they vie for their party nominations in a closely watched election cycle. The results point to strong voter recognition and support for Crockett in the Democratic primary and Paxton in the Republican primary.

The poll, conducted among likely primary voters across the state, shows Crockett holding a significant lead over her Democratic challenger James Talarico, while Paxton maintains a commanding position among Republican contenders John Cornyn & Wesley Hunt.

According to the poll, Ken Paxton leads with 38 percent of likely GOP primary voters, pulling ahead of incumbent John Cornyn, who trails at 31 percent, while Wesley Hunt remains a distant third at 17 percent. The survey indicates Paxton would hold a commanding advantage in a runoff scenario and currently outperforms Cornyn across nearly every key Republican demographic group, with Latino voters the lone exception, where Cornyn maintains a seven-point edge.

Among Democrats, the poll shows Jasmine Crockett opening a notable lead, capturing 47 percent of likely primary voters compared to 39 percent for James Talarico—a meaningful shift from earlier polling that had Talarico in the lead. While still early, the numbers suggest momentum is consolidating ahead of primaries that will determine the general election matchups.

Jasmine Crockett, a sitting U.S. Representative whose district lines were redrawn out from under her, has responded to political extinction with a desperate lurch toward the U.S. Senate. Her campaign, widely criticized as race-baiting and grievance-driven, has leaned heavily on inflaming urban Democratic turnout while cloaking thin policy substance in fashionable slogans about healthcare and “equity.”

By contrast, Ken Paxton enters the race with a long, battle-tested record as Texas Attorney General, earning fierce loyalty from conservatives for his aggressive defense of state sovereignty, constitutional limits, and successful legal challenges to federal overreach. Though relentlessly targeted by opponents, Paxton’s tenure reflects durability, clarity of purpose, and an unapologetic alignment with the voters he represents—qualities that define his standing in the contest.

The Texas U.S. Senate race draws national attention, as the state remains a critical battleground in determining the balance of power in Congress. With incumbent dynamics and shifting voter demographics at play, the primary outcomes will set the stage for a potentially contentious general election. The Texas Tribune poll serves as an initial benchmark, though voter sentiment could evolve as campaigns intensify and debates unfold in the coming weeks.

Featured

Kristi Noem Commemorates Border Crossing Decline with National Leaders

WASHINGTON, D.C. – Secretary of Homeland Security Kristi Noem joined national security leaders in a dual-state event to commemorate a historic decline in border crossings, according to an official release from the Department of Homeland Security. The event spanned two locations, Arizona and North Dakota, in a single day, highlighting coordinated efforts to strengthen border security. Noem, alongside other officials, marked the achievement as a significant milestone in national security policy.

The Department of Homeland Security reported a measurable drop in unauthorized border crossings, attributing the success to enhanced enforcement measures and inter-agency collaboration. Specific data on the decline was not detailed in the initial announcement, though officials emphasized the impact of recent policy implementations. The two-state commemoration underscored the geographic breadth of the issue, addressing both southern and northern border concerns.

In Arizona, Noem and security leaders reviewed operations along the southern border, a longstanding focal point for immigration enforcement. Later in the day, the group traveled to North Dakota to assess northern border security, an area often overlooked in national discussions but critical to comprehensive policy. The dual focus aimed to demonstrate a unified approach to protecting all U.S. borders, per the department’s statement.

The official release from Homeland Security included remarks from Noem, who praised the dedication of personnel involved in the effort. “This decline in crossings is a testament to the hard work of our agents and the effectiveness of our strategies,” she said. Her comments were echoed by other leaders present, though no additional direct quotations were provided in the initial report.

Background on the border security initiatives reveals a multi-year push to address vulnerabilities at both entry points. Southern border challenges, particularly in Arizona, have long dominated policy debates due to high volumes of crossings and complex terrain. Meanwhile, northern border issues in states like North Dakota often involve different dynamics, including trade security and seasonal migration patterns. The Department of Homeland Security has prioritized resources for both regions, though specific funding allocations remain undisclosed in the latest update.

The cause of the reported decline ties directly to recent enforcement actions, though exact mechanisms were not specified in the announcement. Officials pointed to improved technology, increased staffing, and stronger partnerships with local and state authorities as contributing factors. Further details on these efforts are expected in forthcoming reports from the department, which has committed to transparency on border metrics.

Opinion

The recognition of a decline in border crossings signals a potential turning point in how the nation secures its frontiers. Celebrating this achievement in two distinct regions reinforces the importance of a comprehensive strategy that does not neglect less-discussed areas like the northern border.

Events like these also serve as a reminder that security is not a partisan issue but a fundamental duty of government. Prioritizing resources and personnel to protect sovereignty while maintaining lawful entry processes should remain a core focus, ensuring that progress is sustained through consistent policy and accountability.

You must be logged in to post a comment Login