Kovacs’ Wildfire: Unraveling Fate City Manager ‘Fire-Support’ Scheme

In a developing investigation, the Fate Tribune has uncovered potential corruption within the City of Fate surrounding the Lafayette Crossing development project. Recent revelations shed light on a series of covert maneuvers aimed at advancing the contentious project while stifling opposition and shaping public opinion.

At the heart of this unfolding scandal is the mysterious relationship between City Manager Michael Kovacs and Ryan Breckenridge, proprietor of “BRK Partners”. Breckenridge is allegedly pivotal in what Kovacs has referred to as “fire support” and “public education” efforts concerning the Lafayette Crossing development.

Documents obtained by the Fate Tribune indicate that City of Fate administrators were unaware of Breckenridge until the moment of receipt of his invoice, suggesting that his connection was not with the City in general, but with the City Manager directly. According to email correspondence, Breckenridge was not listed as a “vendor” in the city’s database and administrators had no idea what to do with his invoice. Nevertheless, payment for BRK Partners’ services, totaling $4500, was directly authorized by City Manager Michael Kovacs without explanation.

In an open records request (ORR) made by the Fate Tribune, we asked for a copy of the agreement with BRK Partners. Apparently, no such contract exists, according to City Secretary Vickey Raduechel. The sum total of the explanation for the services to be provided by BRK Partners is on the invoice provided by BRK Partners themselves.

The absence of any formal contract delineating the scope of Breckenridge’s services raises serious concerns about transparency and legality. Moreover, the direct authorization of payment by Kovacs adds further suspicion of a coverup to this situation.

Breckenridge’s services, as indicated on their invoice, state “Strategic messaging and external communications consulting services.” But a timeline of events clearly shows what those services would include.

The timeline of events underscores a concerted effort by city officials to control the narrative surrounding Lafayette Crossing development.

On January 9, 2024, Kovacs referred to the project as “…our Olympics” in an email to the city council, emphasizing its significance and outright stating that an impending public relations campaign aimed at “educating” citizens would be underway shortly. Kovacs’ refers to this campaign as “fire-support”, allegedly to provide cover and backup to the Council. This suggests a covert strategy to be waged against people who might oppose the project was deliberately formulated by city executives. As the primary vocal opponent of the project, the Fate Tribune would be included in this group … we assume.

“We have some things in the works for fire-support to you all. Justin talking with PR team Thursday and we launch public education post info Friday (likely) or Tuesday (latest).”

Michael Kovacs in email to City Council

On January 7, 2024, Breckenridge joined the “It’s All About Fate” group on Facebook. Some might infer that that this was prep work for the campaign that was about to unfold. Four days later, Breckenridge was briefed on the project’s status during a City Teams Meeting on January 11, 2024, organized by Luke Franz, attorney for the Lafayette Crossing developers.

On the same day, after the ‘Teams’ meeting, Ryan Wells, Fate City Planner, forwarded the development plans to the “Fate Comprehensive Plan Advisory Committee Members”, via a blind carbon copy of an email to the council, indicating an attempt to be covert. One might infer that this too was part of the campaign as the development was scheduled to be presented before the Planning and Zoning meeting (P&Z) on January 18, 2024, and subsequently, the City Council meeting on February 5, 2024.

In email correspondence to the City Council, prior to the P&Z meeting, Kovacs states his assurances that the project will pass, albeit with a lot of conditions. It begs to question, what would give Kovacs such a firm belief that the project would pass without question? Did he have communication with P&Z members that was not recorded as part of the official documents? How would he know such things? Was the P&Z approval a forgone conclusion before the commission even looked at the submittal?

In a true Republic, every single member of the Fate City Council should be furious that the City Manager would take it upon himself to conduct a covert public manipulation campaign against private citizens or media … but apparently, the City Manager had no qualms about discussing this with the Council openly. This may suggest a mutual understanding and tacit agreement by the Council whose job is to oversee the City Manager.

The authorization for payment to BRK Partners without a formal contract, coupled with Breckenridge’s undisclosed relationship with the City Manager, and the apparent coordination between city officials and developers, raises serious ethical and legal concerns. The Fate Tribune would recommend the Fate City Council conduct a thorough investigation into the conduct of Michael Kovacs with regard to his contract procedures.

The Fate Tribune investigation into the City of Fate’s relationship with the developers of the Lafayette Crossing is ongoing and we are awaiting the distribution of additional documents, emails and text messages. As the controversy surrounding Lafayette Crossing continues to unfold, it is imperative that the voices of citizens and independent media outlets are not silenced by covert tactics and manipulation. The Tribune remains steadfast in its commitment to uncovering the truth behind this troubling affair and holding those responsible to account for their actions.

*Correction 3/18/2024 – We incorrectly referred to Kovacs note of “Fire Support” as “Fire Control” in one of the two paragraphs. We have corrected the article.

Council

Two Open Council Seats, Plus A Recall That Could Reshape City Hall

FATE, TX – Fate voters are heading into a May 2 election that could fundamentally rearrange the city’s governing body.

Two City Council seats are open, with no incumbents seeking reelection. At the same time, residents will weigh a recall question targeting sitting Council Member Codi Chinn. If the recall succeeds, the newly seated council, whatever its composition after the election, would appoint someone to fill the resulting vacancy.

Taken together, the ballot presents more than routine municipal housekeeping. It presents a potential structural reset.

Who Is On The Ballot

For Council Member, Place 2, voters will choose between Lorna Grove and Ashley Rains. The seat is currently held by Mark Harper, who opted not to run for another term.

For Council Member, Place 3, Melinda McCarthy faces Allen Robbins, a former Fate councilman. That seat is currently held by Scott Kelley, who also chose not to seek reelection.

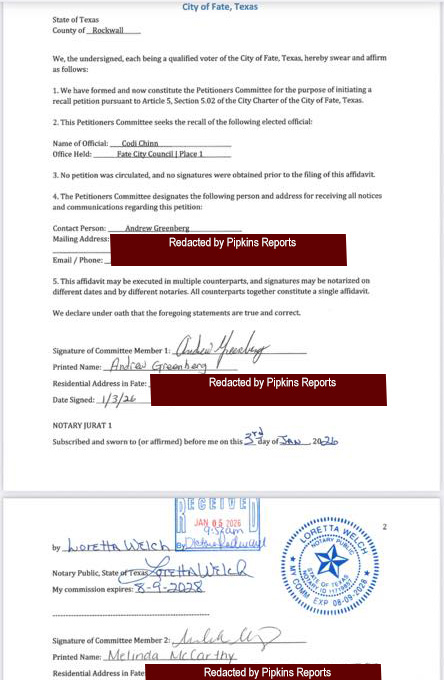

In addition, the ballot includes a recall measure concerning Council Member Codi Chinn. Under Texas municipal law, recall elections allow voters to decide whether an elected official should remain in office before the end of a term. If a majority supports removal, the position becomes vacant.

What Happens If The Recall Succeeds

If voters approve the recall, the City Council would be responsible for appointing a replacement to serve out the remainder of the term, unless the city council calls a special election. In Fate’s case, the council has authority to fill a vacancy by appointment.

That means the composition of the council immediately after May 2 will matter significantly. The same body that voters help shape at the ballot box would select the individual who fills the recalled member’s seat.

In practical terms, voters are not only choosing two new council members. They may also be indirectly influencing who could become a third.

Council

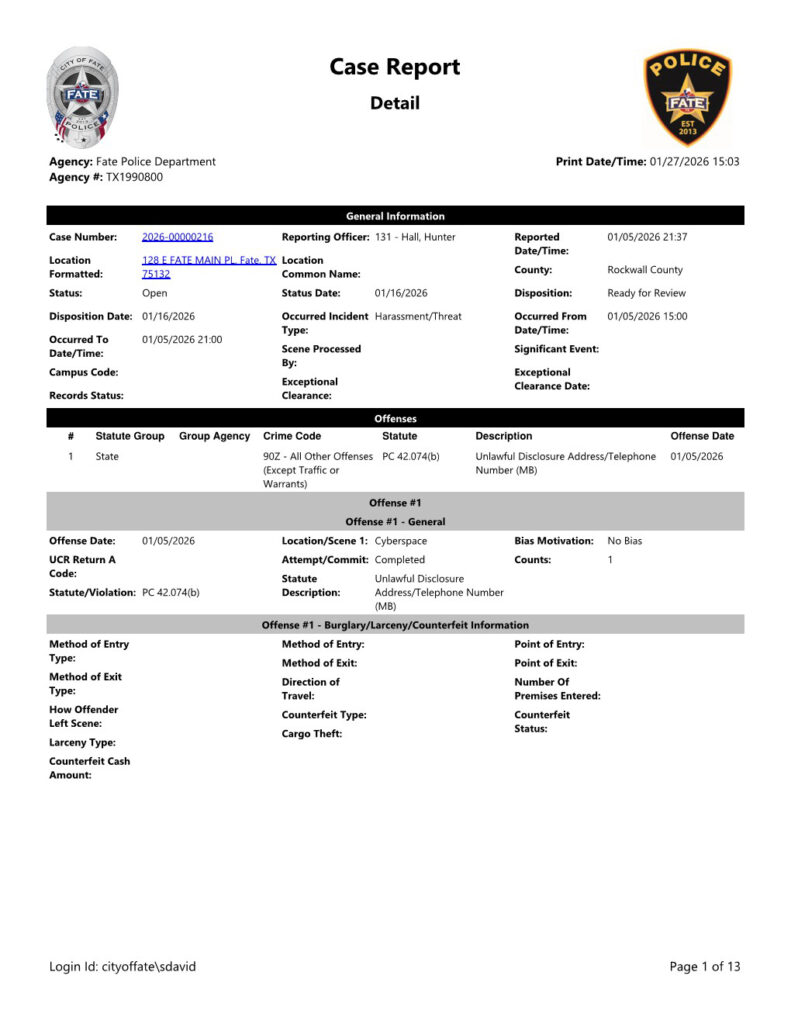

Police Report Names Fate Councilwoman as Suspect in Unlawful Disclosure Case

FATE, TX – In the weeks after a citizen-led recall petition was filed against Fate Councilwoman Codi Chinn, the political fight moved from City Hall into a police case file.

A criminal complaint obtained through an open records request shows the Fate Police Department opened Case #2026-00000216 listing Chinn as a suspect in an investigation under Texas Penal Code §42.074(b) — Unlawful Disclosure of Address or Telephone Number. The report classifies the alleged offense as having occurred in “Cyberspace” and notes the offender was suspected of using a computer. The case status is listed as Open / Ready for Review, and no charges have been filed as of publication.

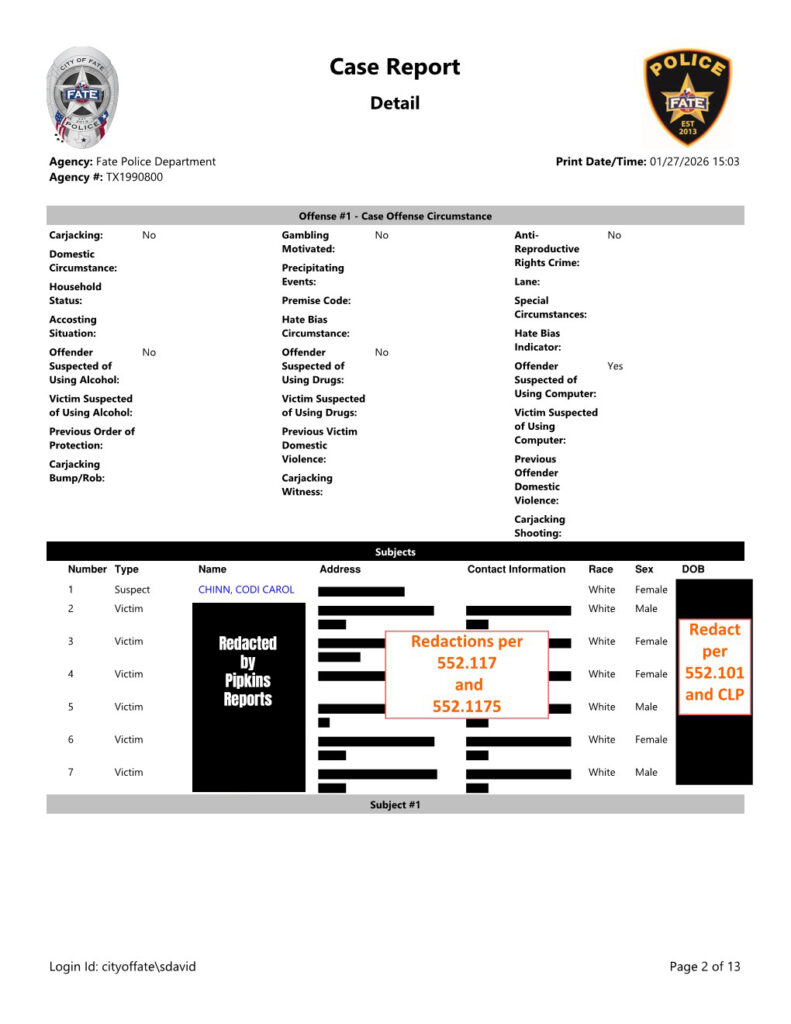

The report identifies multiple Fate residents as victims — whose names we have redacted. The remaining redactions, which includes addresses of the victims as shown on the documents below, were made by the City of Fate.

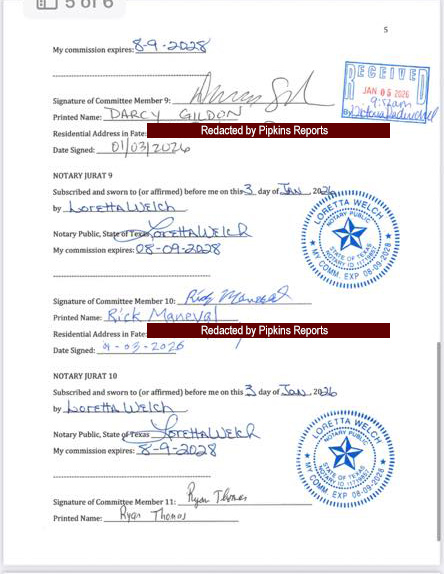

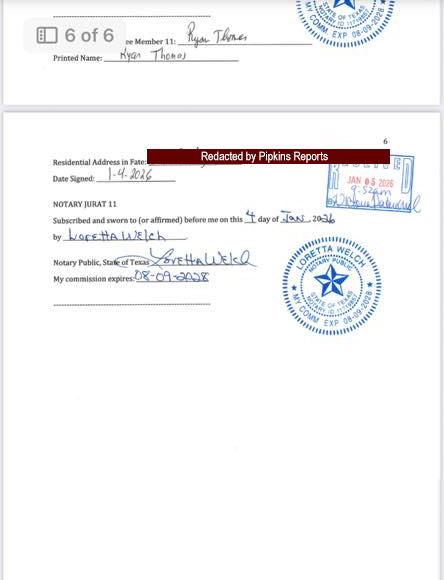

[Pages of complaint against Fate Councilwoman Codi Chinn received via Open Records Request. Pipkins Reports has provided an additional redaction to the victims names.]

What triggered the complaint

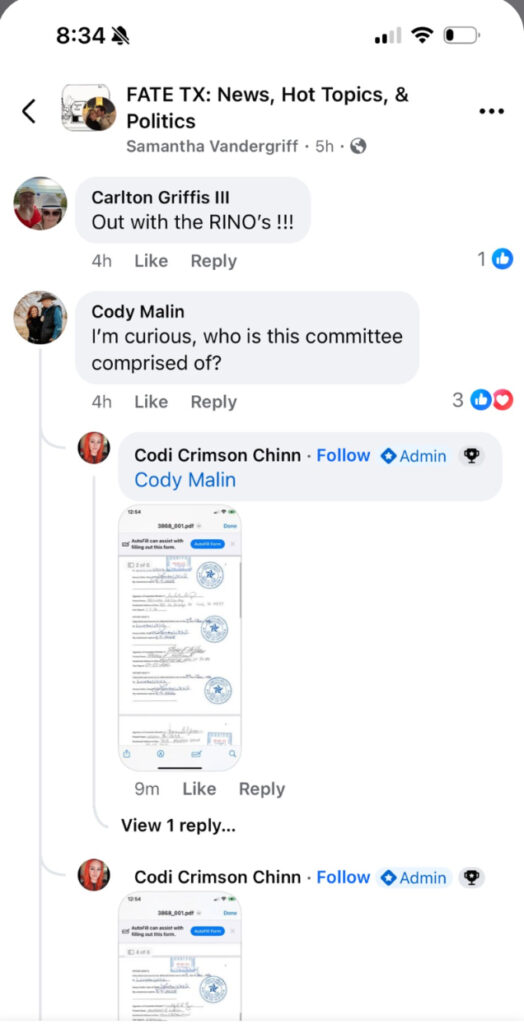

According to the complainants, after the recall petition was formally submitted to the City of Fate, the document — which included the names and home addresses of the recall committee members — was distributed by the city manager to all members of the city council, including Chinn. The citizens allege that Chinn later posted images of the unredacted petition pages on Facebook, thereby displaying the names and residential addresses of those responsible for initiating the recall.

Some of the petition committee members then filed a criminal complaint, asserting the disclosure exposed them to potential harassment and intimidation. The police report reflects that allegation by citing the specific statute related to unlawful disclosure of personal information.

A public statement of fear

During Fate City Council meetings on February 2, 2026 and the following week on February 9, 2026, some individuals spoke during the public comment period and stated, on the record, that they believe the disclosure has placed both themselves and their family in danger. One person spoke about how their children were harassed and frightened. She even spoke about how her children have taken to carry nerf guns … in case something happened to daddy and they needed to protect mommy.

The law at the center of the case

Texas Penal Code §42.074 — Unlawful Disclosure of Personal Information

Texas law makes it a criminal offense to post on a publicly accessible website, or distribute electronically, the home address or telephone number of an individual with intent to cause harm or threaten harm.

- Classified as a Class B misdemeanor

- Elevated to Class A if bodily injury results

- Contains an exemption for public servants only when releasing information as part of their official duties in accordance with law.

The statute does not prohibit publishing a person’s name or signature. It specifically protects residential address and telephone number. Furthermore, the mere posting of an address, absent intent to harm, does not automatically satisfy the statute.

That distinction is central to the complaint.

Why this is unusual

Recall petitions are public political documents. Names of organizers are not confidential. Addresses, however, are often redacted by municipalities before release in open records responses.

Page Cropping and Redactions by Pipkins Reports.]

The complainants argue that while the petition itself is public, the manner in which it was posted — unredacted, on social media, without city review — falls outside normal procedure and outside any official city function.

There is also no record indicating that Chinn was designated by the city in any official capacity to disseminate public records or communicate such materials to the public. The City of Fate maintains a Public Information Officer (PIO) role specifically tasked with handling the release of documents and public communications.

The police report does not determine intent. It documents that a complaint was made, identifies a statute, and names a suspect.

What the police document confirms

The report confirms:

- A complaint was filed January 5, 2026

- The alleged incident occurred online

- A specific criminal statute was cited

- Chinn is listed as the suspect

- The listed victims are recall participants

- The case is active and under review

It does not state that a crime occurred. It does not assign motive. It does not announce charges. It establishes that law enforcement considered the allegation serious enough to open a formal case.

The public servant exemption question

A key issue likely to be examined by prosecutors is whether Chinn’s posting of the petition falls under the statutory exemption for public servants acting within their official duties. The exemption applies only when disclosure is required by law or when disclosure is performed as part of an official governmental function.

The complainants contend that Chinn is not the city Public Information Officer (PIO) and is not authorized to post information on behalf of the city. They allege that posting the document to a personal Facebook page, without redaction and without city authorization, does not meet that threshold. They allege that the disclosure functioned as retaliation for initiating the recall.

What happens next

The case status of “Ready for Review” indicates the report has been forwarded for prosecutorial consideration. Whether the matter results in charges will be determined by the Rockwall County District Attorney, Kenda Culpepper, after review of the evidence.

Until then, the matter remains an open investigation.

Why this matters beyond Fate

Texas’ unlawful disclosure statute is increasingly cited in cases involving online publication of personal data. The law was designed to address modern forms of harassment often referred to as “doxxing.”

This case tests how that statute applies when the disclosure occurs in the context of a political dispute between elected officials and citizens.

It raises a novel question:

When does sharing a public document cross into unlawful disclosure?

That answer now sits in a police file.

Documentation

All information in this report is drawn from the Fate Police Department case report obtained through an open records request and social media sources. Home addresses, or potential victims’ names from the petition are not presented here to avoid republishing the information at issue in the investigation.

Pipkins Reports reached out to Councilwoman Chinn for comment before publication and received a call from her attorney, Cody Skipper, with Shook & Gunter Attorney at Law. Skipper’s response was, “Codi Chinn has done nothing wrong, nothing illegal, nothing unethical. Codi Chinn has done her job as a public servant.“

We also asked Mr. Skipper if he thought that when she posted the petition, if she was acting in an official capacity. He stated, “Every one of these people are acting in an official capacity.”

We have also verified that the Facebook post containing the recall petition with the committee members’ addresses has been removed. It is unclear when the post was removed.

Council

Fate City Council Votes to Release Secret Recordings

Councilman Mark Harper walks out of meeting before adjournment.

FATE, TX – The Fate City Council voted late Monday night to waive deliberative privilege, opening the door to the public release of secret audio recordings that may have driven a recall election against Councilwoman Codi Chinn. The decision came after hours of public criticism, procedural friction, and a lengthy executive session with legal counsel.

The meeting, held Monday, February 2, was streamed live by the city and is available on YouTube at: https://www.youtube.com/live/zQVN0i-d8C0 (Embedded Below)

(Source: City of Fate, official meeting broadcast)

Timeline for Readers

- 00:33:52 – Public comments begin, largely focused on the recall election of Councilwoman Codi Chinn.

- 00:56:10 – Councilman Harper interrupts public Comment.

- 00:57:00 – Councilman Harper interrupts public Comment.

- 00:58:00 – Councilman Harper interrupts public Comment.

- 02:21:00 – Executive Session – Council enters closed session to consult with legal counsel.

- 03:22:52 – Council reconvenes in open session.

- Primary motion – Council votes to “waive deliberative privilege”, allowing release of disputed audio recordings.

Public Comment and Visible Strain

Public comments began just after the 33 minute mark and quickly centered on the recall election. Speaker after speaker questioned the conduct of city officials and demanded transparency regarding audio recordings that have circulated privately but remained unavailable to the public.

During one speaker’s remarks, critical of Councilwoman Chinn, procedural tension became visible. Three separate times, Councilman Mark Harper interrupted to remind Mayor Andrew Greenberg that the speaker had exceeded the three-minute time limit. Each time, Mayor Greenberg thanked Harper for the reminder, then directed the speaker to continue.

The exchange stood out. While council rules clearly limit speakers to three minutes, the mayor’s repeated decision to allow the speaker to proceed suggested an effort to avoid the appearance of silencing criticism during a highly charged meeting.

Clarifying the Recordings

Contrary to some early assumptions, the audio recordings at issue were not recordings of executive sessions. Instead, they are one-party consent recordings, the existence of which has been previously reported and alluded to on Pipkins Reports. Their precise origin has not been publicly detailed, but their contents have been referenced repeatedly by both supporters and critics of the recall effort.

Behind Closed Doors

Following the public meeting, the council entered executive session to consult with legal counsel. After about an hour, members returned to open session at approximately 3:22:52 .

The primary motion coming out of that session was to “waive deliberative privilege“. The effect of the vote was to remove a legal obstacle to releasing the secret audio recordings that have been at the center of the controversy.

No excerpts were played, and no conclusions were announced. The council did not rule on the legality of the recordings, nor did it weigh in on the merits of the recall election itself.

Why the Vote Matters

The decision does not resolve the recall of Councilwoman Chinn. It does not validate or refute claims made by either side. What it does is shift the debate away from rumor and secondhand accounts.

According to guidance from the Texas Municipal League, governing bodies may waive certain privileges when transparency is deemed to serve the public interest, particularly when litigation risk is balanced against public trust (Texas Municipal League, Open Meetings Act resources).

Opinion and Perspective

The council’s action was a necessary step. Secret recordings, selectively referenced and strategically leaked, undermine confidence in local government. So does a refusal to confront them directly.

Transparency is not about protecting officials from embarrassment. It is NOT the job of the council to assist the city in concealing information that may be used against it in legal proceedings when the City Manager, or Councilmen, may have done bad things. It is about protecting citizens from manipulation. If the recordings exonerate those involved, their release will restore credibility. If they raise concerns, voters deserve to hear them unfiltered before making decisions in a recall election.

Monday night in Fate did not end the controversy. It ended the excuse for keeping the public in the dark.

You must be logged in to post a comment Login