The $202 Billion Lie: Why Politicians Can’t Deliver Property Tax Freedom

Debt, Not Willpower: How $202.6 Billion in Voter-Approved School Bonds Is the Ball-and-Chain on Eliminating Property Taxes

Austin, TX — The biggest obstacle to lawmakers who promise to abolish or drastically cut school property taxes isn’t partisan gridlock or an unwilling governor. It’s money that voters already agreed to borrow: roughly $202.6 billion in outstanding independent school district bond debt — a sum that, when spread across Texas’ 5.5 million students, works out to about $36,800 per student and effectively locks future legislatures into continuing property-tax collections to pay that debt.

The fairness dilemma: why should the prudent subsidize the spendthrift?

Beyond the staggering numbers, fairness has emerged as a central challenge. When voters in one district approve hundreds of millions in bonds — for new stadiums, performing arts centers, or expansive building programs — those debts become locked-in obligations. But if the Legislature were to eliminate property taxes and shift to a statewide funding model, the costs don’t stay local. Taxpayers in fiscally disciplined districts, who either voted down bonds or avoided extravagant projects, would end up subsidizing the debt of their neighbors.

This creates a thorny equity problem: one community’s appetite for borrowing can effectively hold the entire state hostage, delaying property-tax elimination for everyone. Responsible districts — those that avoided over-leveraging their tax base — are forced into the same long repayment cycle as the districts that went all-in on debt. Lawmakers warn that unless Texas finds a way to firewall these obligations, the drive to abolish school property taxes statewide will continue to falter.

The numbers you need to know

A Texas Policy report and the state’s debt-tracking data show that outstanding ISD bond debt reached $202.6 billion in the most recent reporting year — the largest single component of local government borrowing in Texas.

Spread across Texas’ student enrollment, that comes to roughly $36,800 per student. That debt does not vanish if lawmakers change the tax code. It remains a contractual obligation backed by the taxing authority that issued it — and this legal reality ties the Legislature’s hands.

Lawmakers on record: bonds drive the property-tax problem

“Taxes are higher than if there was no bond … so every bond effectively is a tax increase,” said Rep. Brian Harrison (R-Midlothian) during a 2023 debate about school finance.

Rep. Morgan Meyer (R-Dallas), who carried HB 19 in 2025 to curb runaway local debt, framed it directly: “We can’t talk about eliminating property taxes while leaving the bond spigot wide open. Every dollar borrowed today is a tax locked in for the next 20 to 30 years.”

These blunt statements reflect why the bulk of legislative proposals in recent years have targeted future bond elections — raising voter approval thresholds, moving them to higher-turnout November ballots, and requiring more transparency about long-term costs. None of these measures erase the existing debt, but they aim to prevent further accumulation that would worsen the fairness gap between districts.

The political paradox: voters approved the problem

The irony is that most of this debt wasn’t foisted on Texans by bureaucrats alone — voters themselves approved these bonds at the ballot box. In many cases, school districts have resorted to scare tactics and emotional appeals to secure that approval.

The pitch is often less about fiscal prudence and more about guilt. Campaign slogans and superintendent talking points regularly frame the choice in moral terms: “If you don’t approve this, you must not support teachers,” or “Our teachers deserve more,” or the ever-present line, “It’s for the children.” Newer tactics now include, “You must not have children in school.” , “Teachers are paying out of their own pockets.” These carefully crafted appeals make resistance politically difficult, especially in tight-knit communities where opposing a bond can be painted as opposing kids or education itself.

And the strategy has worked. Across Texas, billions in bonds have sailed through under this messaging, saddling districts with long-term debt and tying the hands of future legislatures. The political paradox is this: the same voters who demand relief from crushing property taxes are also the ones who — swayed by emotional campaigns — have made that relief harder to achieve by approving bonds that lock in tax obligations for decades.

But those local “yes” votes have statewide consequences. The debt must be repaid, and repayment requires continued property-tax collections. For legislators aiming to abolish school property taxes, the very taxpayers clamoring for relief are also the ones who made that task exponentially harder by approving bonds.

Options — none are painless

- State buyout of local debt: A one-time appropriation of $202.6 billion is politically and fiscally unrealistic.

- Refinancing or defeasing debt: Lowers payments but doesn’t erase obligations.

- Raising voter thresholds for new bonds: Limits future growth but doesn’t fix existing debt.

- State assumption of debt: Shifts the burden, raising fairness concerns between high-debt and low-debt districts.

Each option forces the same uncomfortable conversation: who pays for decisions already made?

Bottom line

The dream of eliminating school property taxes runs headfirst into a wall of accumulated debt — $202.6 billion worth of it, or $36,800 per student. And until Texans reconcile the fairness problem — why should one district’s fiscal responsibility be undercut by another’s binge borrowing? — the debate will remain stuck.

Worse still, there’s a sleight of hand at work in many school districts. As soon as one bond issue approaches its final payment, local boards are quick to put another bond on the ballot. Instead of allowing taxpayers to enjoy the natural drop in property-tax rates that should come with retired debt, they simply roll that expiring tax into a new long-term obligation.

Districts then market these bonds with the line, “This will not raise your tax rate.” Technically true — but deeply misleading. What they are really saying is that your tax rate will not go down as it should have. The tax reduction that rightfully belongs to homeowners is effectively stolen, replaced with a new debt service that locks in the same tax burden for decades more.

This cycle ensures that property taxes never truly fall, even when debt is paid off. It’s a fiscal treadmill: as old obligations expire, new ones are issued, keeping taxpayers perpetually on the hook. That practice is one reason why the total statewide school bond debt has continued to climb rather than shrink.

For lawmakers and taxpayers alike, the conclusion is unavoidable: unless the bond game itself is reined in, every promise of property-tax elimination will remain an illusion. Texans cannot escape the burden of perpetual debt service so long as school districts treat bond expirations not as a chance to lower taxes, but as an opportunity to keep the gravy train running.

Fate, TX

CyberSquatting City Hall: How City Claimed a Developer’s Domain

How Fate registered a developer’s project domain after seeing it in official plans, then fought to keep that fact hidden

FATE, TX – Cities are expected to regulate development, not steal its name.

Records obtained by Pipkins Reports show the City of Fate registered the domain name of a private development, lafayettecrossing.com, while actively working with the developer who had already claimed that name in official plans. The move, made quietly during a heated approval process, raises serious questions about whether Fate’s city government crossed from partner to predator, taking digital ownership of a project it was supposed to oversee with neutrality and good faith… and depriving the developer of their rights to domain ownership.

What followed, attempts to conceal the purchase, shifting explanations from city officials, and a documented pattern of advocacy on behalf of the developer, suggests the domain registration was not an accident, but part of a broader effort to control the narrative around one of the most divisive projects in the city’s history.

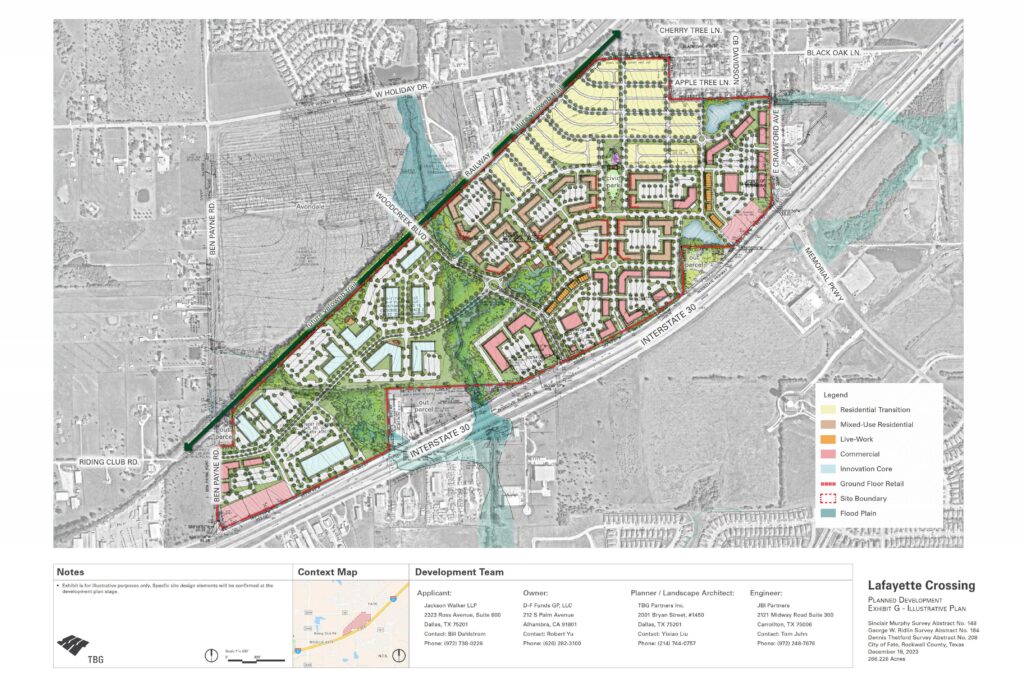

A site plan submitted by the developer, D-F Funds GP, LLC, led by Robert Yu, shows the project title “Lafayette Crossing” clearly identified in the title block on December 20, 2023. The document was part of the city’s official development review for the controversial project at the corner of I-30 and Highway 551.

Less than two months later, on February 7, 2024, the City of Fate registered the domain lafayettecrossing.com, Invoice #116953461, for $12.

Domain records confirm the registration date, with the domain set to expire on February 7, 2027. By that point, Lafayette Crossing was already the established name of the project, used by the developer and embedded in official plans circulating within City Hall.

This was not a coincidence. The city had the plans from the developer. Their were extensive talks regarding the project. Then the city registered the domain without the knowledge of the developer. This is known in the industry as, “Cybersquatting.”

The development, originally referred to as the “Yu Tract,” became known as Lafayette Crossing as it moved through the approval process. The project ignited intense public opposition over density, traffic congestion, infrastructure strain, and the long-term direction of Fate’s growth. Despite sustained resistance and packed council chambers, the city council approved the project.

The political fallout was severe. In the elections that followed, four council members and the mayor were replaced, an extraordinary level of turnover that reflected deep voter dissatisfaction. Two members from that Council, Councilman Mark Harper and Councilman Scott Kelley, remain, but are up for reelection this May.

That context matters, because the domain registration did not occur in isolation. It occurred amid a broader, documented pattern of city officials actively working to shape public perception in favor of the developer.

In February 2024, Pipkins Reports, then operating as the Fate Tribune, published an exposé based on internal city emails showing City Manager Michael Kovacs discussing strategies to “educate” the public about Lafayette Crossing. In those emails, Kovacs suggested deploying what he referred to as “Fire Support,” a term used to describe both paid and unpaid advocates brought forward to counter citizen opposition and astroturf public support for the project.

That reporting revealed a city government not merely responding to public concerns, but actively attempting to manage and counter them.

In a later publication, Pipkins Reports (Fate Tribune) documented the City of Fate’s hiring of Ryan Breckenridge of BRK Partners, engaging in what records showed to be a coordinated public relations effort aimed at improving the project’s image and swaying public sentiment. The campaign was presented as informational, but residents viewed it as advocacy on behalf of the developer, funded with public resources.

It was within this environment, where city staff had already aligned themselves publicly and privately with the developer’s interests, that the city registered the lafayettecrossing.com domain. Yet that fact remained hidden until PipkinsReports.com submitted an Open Records Request on September 30, 2025, seeking a list of all domains owned by the city.

Rather than comply, the City of Fate objected. On October 14, 2025, officials asked the Texas Attorney General’s Office for permission to withhold the records, citing “cybersecurity” concerns.

On January 6, 2026, the Attorney General rejected that claim and ordered the information released. The city complied on January 20, 2026.

In addition to the lafayettecrossing.com domain, the records revealed the city owns numerous domains tied to redevelopment and branding initiatives, including:

- FateTX.gov

- DowntownFate.com

- FateFoodHaul.com

- FateMainStreet.com

- FateStationHub.com

- FateStationMarket.com

- FateStationPark.com

- FateStationSpur.com

- OldTownFate.com

- TheHubAtFateStation.com

- TheSpurAtFateStation.com

- ForwardFate.com

Most clearly relate to city-led initiatives. LafayetteCrossing.com stands apart because it mirrors the established name of a private development already proposed, named, and publicly debated.

When questioned via email, Assistant City Manager Steven Downs initially suggested the domain purchase occurred long before his involvement and downplayed any potential issues. When we revealed documents to show Downs was actively engaged with the project at the same time the Lafayette Crossing name entered the city’s official workflow, his story changed.

In follow-up correspondence, Downs acknowledged he was aware of the project name, while placing responsibility for the domain purchase on former Assistant City Manager Justin Weiss. Downs stated he did not know whether the developer was aware of the purchase and said he was not concerned about potential liability.

What remains unexplained is why the city registered the domain at all, knowing it belonged to a private project, and why it attempted to keep that information from the public.

Opinion

Viewed in isolation, a $12 domain purchase might seem trivial. Viewed in context, it is not.

When a city that has already worked to astroturf support, hire public relations firms, and counter citizen opposition also quietly registers a developer’s project domain, then attempts to conceal that information from the public, the line between regulator and advocate disappears.

The question is no longer whether the city knew the name. The record shows it did.

The question is why a city government so deeply invested in selling a controversial project to its residents felt the need to take ownership of the project’s digital identity as well.

Control of messaging, control of perception, and control of narrative are powerful tools. Sometimes it is equally as important to control what is not said.

Election

New Poll Shows Crockett, Paxton Leading Texas Senate Primary Contests

Texas Senate Primaries Show Early Leads for Crockett and Paxton

AUSTIN, Texas – A new poll released by The Texas Tribune indicates that Jasmine Crockett and Ken Paxton are leading their respective primary races for the U.S. Senate seat in Texas. The survey, published on February 9, 2026, highlights the early momentum for both candidates as they vie for their party nominations in a closely watched election cycle. The results point to strong voter recognition and support for Crockett in the Democratic primary and Paxton in the Republican primary.

The poll, conducted among likely primary voters across the state, shows Crockett holding a significant lead over her Democratic challenger James Talarico, while Paxton maintains a commanding position among Republican contenders John Cornyn & Wesley Hunt.

According to the poll, Ken Paxton leads with 38 percent of likely GOP primary voters, pulling ahead of incumbent John Cornyn, who trails at 31 percent, while Wesley Hunt remains a distant third at 17 percent. The survey indicates Paxton would hold a commanding advantage in a runoff scenario and currently outperforms Cornyn across nearly every key Republican demographic group, with Latino voters the lone exception, where Cornyn maintains a seven-point edge.

Among Democrats, the poll shows Jasmine Crockett opening a notable lead, capturing 47 percent of likely primary voters compared to 39 percent for James Talarico—a meaningful shift from earlier polling that had Talarico in the lead. While still early, the numbers suggest momentum is consolidating ahead of primaries that will determine the general election matchups.

Jasmine Crockett, a sitting U.S. Representative whose district lines were redrawn out from under her, has responded to political extinction with a desperate lurch toward the U.S. Senate. Her campaign, widely criticized as race-baiting and grievance-driven, has leaned heavily on inflaming urban Democratic turnout while cloaking thin policy substance in fashionable slogans about healthcare and “equity.”

By contrast, Ken Paxton enters the race with a long, battle-tested record as Texas Attorney General, earning fierce loyalty from conservatives for his aggressive defense of state sovereignty, constitutional limits, and successful legal challenges to federal overreach. Though relentlessly targeted by opponents, Paxton’s tenure reflects durability, clarity of purpose, and an unapologetic alignment with the voters he represents—qualities that define his standing in the contest.

The Texas U.S. Senate race draws national attention, as the state remains a critical battleground in determining the balance of power in Congress. With incumbent dynamics and shifting voter demographics at play, the primary outcomes will set the stage for a potentially contentious general election. The Texas Tribune poll serves as an initial benchmark, though voter sentiment could evolve as campaigns intensify and debates unfold in the coming weeks.

Featured

Kristi Noem Commemorates Border Crossing Decline with National Leaders

WASHINGTON, D.C. – Secretary of Homeland Security Kristi Noem joined national security leaders in a dual-state event to commemorate a historic decline in border crossings, according to an official release from the Department of Homeland Security. The event spanned two locations, Arizona and North Dakota, in a single day, highlighting coordinated efforts to strengthen border security. Noem, alongside other officials, marked the achievement as a significant milestone in national security policy.

The Department of Homeland Security reported a measurable drop in unauthorized border crossings, attributing the success to enhanced enforcement measures and inter-agency collaboration. Specific data on the decline was not detailed in the initial announcement, though officials emphasized the impact of recent policy implementations. The two-state commemoration underscored the geographic breadth of the issue, addressing both southern and northern border concerns.

In Arizona, Noem and security leaders reviewed operations along the southern border, a longstanding focal point for immigration enforcement. Later in the day, the group traveled to North Dakota to assess northern border security, an area often overlooked in national discussions but critical to comprehensive policy. The dual focus aimed to demonstrate a unified approach to protecting all U.S. borders, per the department’s statement.

The official release from Homeland Security included remarks from Noem, who praised the dedication of personnel involved in the effort. “This decline in crossings is a testament to the hard work of our agents and the effectiveness of our strategies,” she said. Her comments were echoed by other leaders present, though no additional direct quotations were provided in the initial report.

Background on the border security initiatives reveals a multi-year push to address vulnerabilities at both entry points. Southern border challenges, particularly in Arizona, have long dominated policy debates due to high volumes of crossings and complex terrain. Meanwhile, northern border issues in states like North Dakota often involve different dynamics, including trade security and seasonal migration patterns. The Department of Homeland Security has prioritized resources for both regions, though specific funding allocations remain undisclosed in the latest update.

The cause of the reported decline ties directly to recent enforcement actions, though exact mechanisms were not specified in the announcement. Officials pointed to improved technology, increased staffing, and stronger partnerships with local and state authorities as contributing factors. Further details on these efforts are expected in forthcoming reports from the department, which has committed to transparency on border metrics.

Opinion

The recognition of a decline in border crossings signals a potential turning point in how the nation secures its frontiers. Celebrating this achievement in two distinct regions reinforces the importance of a comprehensive strategy that does not neglect less-discussed areas like the northern border.

Events like these also serve as a reminder that security is not a partisan issue but a fundamental duty of government. Prioritizing resources and personnel to protect sovereignty while maintaining lawful entry processes should remain a core focus, ensuring that progress is sustained through consistent policy and accountability.

You must be logged in to post a comment Login