Cutting Taxpayer Costs in Fate: How Impact Fees Could Lighten the Load for Infrastructure Needs

Had the City of Fate implemented impact fees on developers to address the infrastructure demands of new growth, a $20 million bond—and its associated taxpayer burden—could have been unnecessary. Impact fees, applied strategically, would allow Fate to offset the costs of new public services, roads, water, and emergency services by requiring developers to pay for the added strain their projects place on city infrastructure.

With an informed and experienced council focused on long-term fiscal responsibility, Fate could have positioned itself to harness developer-driven revenue streams. This approach used effectively in cities like Frisco, San Diego, and Fort Collins, has provided critical funding to support growth sustainably, ensuring residents don’t bear the full financial impact of development. By proactively planning for growth in this way, Fate might have avoided the need for a significant bond, creating a model for fiscal efficiency and taxpayer protection. But it’s not too late, the city can offset the cost of the new bond by increasing impact fees immediately.

What Are Impact Fees?

Impact fees are charges that cities levy on developers to cover a portion of the costs associated with public infrastructure demands created by new development. When a new subdivision, shopping center, or commercial area is built, it requires additional public resources—more roads, water, and sewer capacity, and greater public safety coverage. Traditionally, these costs were often shouldered by the general taxpayer. With impact fees, the responsibility for new infrastructure shifts partially or wholly onto developers.

These fees are typically assessed based on the estimated “impact” a development will have on city services. While the structure and application of impact fees vary across jurisdictions, the principle is the same: development should pay for itself, reducing taxpayer burden. The fees can be earmarked for specific projects, such as road expansions, new fire stations, or enhanced public utilities, and are legally restricted for those uses.

How Impact Fees Are Applied

Cities tailor impact fees to meet their unique needs and growth patterns. Some target transportation improvements, while others focus on utilities, public safety, and parks. Texas law allows municipalities to impose impact fees, but guidelines are stringent; fees must be proportionate, directly connected to the development, and justifiable through studies showing the development’s projected impact. This makes impact fees a flexible but carefully regulated tool that, when used effectively, can significantly ease financial strain on local budgets.

Real-World Examples of Impact Fees in Action

To understand how Fate could utilize impact fees, let’s look at five U.S. cities where impact fees have successfully offset infrastructure costs. Each of these cities demonstrates a practical approach Fate could adapt to fund essential services without placing undue burdens on residents.

1. Frisco, Texas: Expanding Services for a Booming Suburb

In the Dallas-Fort Worth metroplex, Frisco stands as a model for proactive growth management through impact fees. Frisco’s development fees are rigorously structured, covering roads, parks, water, and wastewater infrastructure. For residential development, the city imposes impact fees based on lot sizes. For instance:

- Roadway Impact Fees: New residential developments incur roadway impact fees of approximately $8,508 per single-family home lot. For multifamily projects, the fees are about $5,317 per unit.

- Water and Wastewater Impact Fees: For water, Frisco charges around $1.33 per square foot for commercial developments, while wastewater impact fees can add another $0.96 per square foot.

- Parks and Open Spaces: Frisco also assesses fees for parks, amounting to roughly $1,000 per residential unit to ensure parkland and amenities keep pace with population growth.

These fees generate millions annually. For example, in 2022, Frisco collected over $25 million in impact fees, which funded the construction of new roads, utility expansions, and public safety facilities. This approach has allowed Frisco to continue its rapid growth trajectory while maintaining high standards of infrastructure without imposing additional taxes on existing residents.

2. San Diego, California: Transportation and Public Safety

San Diego employs a well-established system of impact fees to fund its regional growth. The city charges developers based on the projected increase in traffic, utility demand, and emergency services. These fees are strategically allocated, with a strong emphasis on expanding roadways, upgrading transit systems, and constructing new fire and police stations. San Diego’s approach ensures that growth directly contributes to maintaining and improving the quality of life for its residents, protecting taxpayers from shouldering the full cost of new infrastructure.

The City of San Diego collects significant funds through impact fees, with specific fees for residential and non-residential developments based on metrics like average daily trips (ADTs) and gross floor area (GFA). For example, in the Midway-Pacific Highway area, impact fees in 2019 included:

- Mobility Facilities: Fees for road and transit improvements amount to $533 per ADT. With an average of 7 ADTs per dwelling unit (DU), this results in $3,731 per residential unit for mobility improvements.

- Fire-Rescue Facilities: Impact fees are set at $164 per DU for residential and $164 per 1,000 square feet of GFA for non-residential buildings.

- Parks and Recreation: Residential developments are also charged $3,723 per DU to support parks and recreation facilities.

The city collected millions annually from these fees to fund various infrastructure projects, including road, park, fire-rescue, and transit improvements, which are distributed across neighborhoods and specifically tailored to meet the infrastructure needs of each development area. For example, Carmel Valley collected over $332,980 for improvements in one fiscal year, while downtown areas saw over $8 million in fees during the same period.

You can find more details on San Diego’s impact fees and projects in their public records site. Here: San Diego.

3. Fort Collins, Colorado: Public Utilities and Affordable Housing

Fort Collins has used impact fees for years to fund water and wastewater services and other public utility upgrades required by new development. By charging developers impact fees dedicated to expanding these utility networks, the city has effectively managed costs while also considering affordable housing needs. Fort Collins recalibrates its impact fees annually, ensuring they accurately reflect the city’s infrastructure expenses and growth trends. This ensures that new development is contributing to community infrastructure, reducing pressure on general tax revenues.

In Fort Collins, the impact fees are known as Capital Expansion Fees (CEFs)—are applied to a variety of development types to fund critical infrastructure, including public safety, parks, and general government facilities. Specific fee amounts vary based on the nature of the development, with detailed rates per square footage and per acre.

For instance, residential development fees for single-family homes in Fort Collins are structured by dwelling size. A dwelling between 1,201 and 1,700 square feet incurs an approximate fee of $3,537 per unit, while larger homes exceeding 2,200 square feet are assessed at $4,982. These fees incorporate costs across parks, fire, police, and general government services, providing a mechanism for the city to support infrastructure needs created by growth without over-burdening existing taxpayers. Non-residential developments are similarly charged: commercial spaces incur around $1,311 per 1,000 square feet, while industrial developments face lower fees, approximately $309 per 1,000 square feet.

In recent years, Fort Collins has adjusted these fees upwards to more accurately reflect the increasing costs of service expansion, aiming to align impact fees with current economic conditions and projected city growth. This adjustment process has helped Fort Collins maintain a steady influx of funding for infrastructure, with CEFs totaling millions annually.

For more specific financial data on Fort Collins’ impact fees, the city’s development and utility fees documentation is publicly accessible at fcgov.com

4. Charlotte, North Carolina: Keeping Pace with Growth

Charlotte is another example of a fast-growing city that relies on impact fees to manage infrastructure costs. As one of the Southeast’s leading economic hubs, Charlotte has seen significant population growth, and increasing demands on roadways, water, sewer, and public safety services. The city implemented impact fees to ensure that new developments fund necessary upgrades, allowing Charlotte to invest in critical infrastructure and services without significantly raising taxes on existing residents.

Charlotte’s focus is on water and sewer infrastructure. Although Charlotte does not traditionally employ broad-based development impact fees like some other municipalities, it leverages other types of fees to fund necessary improvements. One primary revenue source comes from system development fees, which help cover capital costs for expanding water and sewer infrastructure to support new development. These fees are calculated based on projected infrastructure costs and the level of demand that new developments impose on existing resources, ensuring that the city recoups a portion of its costs directly from developers.

In terms of specifics, recent updates reflect Charlotte’s commitment to expanding these fees to maintain high service levels amidst growing demand. Development fees are calculated per gallon for water and sewer usage based on expected capacity needs of each new project. The fees in Charlotte and Mecklenburg County provide a proportional structure, where the higher the demand created by a project, the higher the fees imposed to cover required expansions, which helps balance growth with the city’s fiscal responsibilities.

For further details on how Charlotte calculates and applies these fees, including specific fee schedules and supporting data, you can review their infrastructure planning and fee schedules in their fiscal and planning documentation Charlotte Future 2040.

5. Phoenix, Arizona: Balancing Growth with Infrastructure Needs

Phoenix, a city known for its expansive urban growth, has long used impact fees to finance infrastructure expansion. Fees in Phoenix help fund transportation improvements, water resources, parks, and public safety facilities in growing areas. This allows the city to maintain an orderly expansion without straining existing infrastructure or local budgets. The city’s fees are periodically reviewed and adjusted to align with changes in development patterns and infrastructure needs, ensuring a fair contribution from new projects.

In Phoenix, impact fees are structured to ensure that new development contributes significantly to the infrastructure required to support it. Fees are assessed differently across nine specific impact fee areas within the city, with variations based on the infrastructure needs and density of each zone. For instance, in Paradise Ridge, developers of single-family homes pay $16,824 in total impact fees, while in areas like the Northeast and Northwest, fees for similar developments are approximately $15,092 and $15,169, respectively. Each area has tailored fees to meet its unique requirements, which are recalculated and updated periodically by the city to stay aligned with growth and service demands.

For multi-family, commercial, and industrial projects, Phoenix calculates impact fees based on specific project characteristics, such as building size, location, and water meter requirements, making these assessments more variable. These funds are allocated directly to dedicated accounts and are earmarked strictly for infrastructure that serves each impact area, following city policy to ensure that the cost of growth does not fall on existing residents but is absorbed proportionally by new developments.

More information on Phoenix’s impact fees, including detailed rates by area, is available from the City of Phoenix’s official planning and development department City of Phoenix.

Over a recent period, the city collected over $191 million in development impact fees to support capital facility expansion across various zones, which are strategically divided to ensure that the fees benefit specific areas within Phoenix.

Why Impact Fees Matter for Fate

As one of Texas’ fastest-growing cities, Fate faces the challenge of maintaining quality public services without significantly increasing taxes. With every new subdivision or commercial building, demand rises for road capacity, water and sewer services, and public safety coverage. For a city that aims to uphold fiscal responsibility and quality of life, impact fees present a viable tool. Applying these fees to new developments could allow Fate to:

- Expand Public Safety Facilities: New developments increase the need for police and fire services. Impact fees could help fund the construction or expansion of DPS facilities, ensuring the city maintains safe response times and effective emergency coverage.

- Improve Road Infrastructure: More development inevitably means more traffic. By using impact fees, Fate can plan and execute road improvements, expansions, or upgrades without relying on existing taxpayer funds.

- Bolster Water and Utility Systems: To accommodate the growth in residential and commercial areas, Fate’s water and sewer systems will require upgrades. Impact fees allow the city to invest in these essential systems proactively, protecting both residents and businesses from potential service issues.

- Preserve Open Spaces and Parks: Impact fees could also be allocated to developing and maintaining parks and recreational areas. This aligns with Fate’s desire to maintain an “old-town” feel with communal spaces that enhance residents’ quality of life.

A Strategic Next Step for Fiscal Responsibility

Implementing impact fees is a decision that requires careful planning, transparency, and community involvement. However, as illustrated by Frisco, San Diego, Fort Collins, Charlotte, and Phoenix, when managed effectively, impact fees allow cities to balance growth with fiscal responsibility.

For Fate, impact fees could relieve taxpayer burden and diminish the cost of the DPS bond that just passed by a vote of the people, enabling continued growth while safeguarding the services and infrastructure on which the community relies. As Fate evaluates options for funding its future, impact fees may provide the critical bridge between growth and quality of life, ensuring that the costs of new developments are borne by those who benefit most directly—developers and future residents—while protecting the financial interests of current taxpayers.

Fate, TX

CyberSquatting City Hall: How City Claimed a Developer’s Domain

How Fate registered a developer’s project domain after seeing it in official plans, then fought to keep that fact hidden

FATE, TX – Cities are expected to regulate development, not steal its name.

Records obtained by Pipkins Reports show the City of Fate registered the domain name of a private development, lafayettecrossing.com, while actively working with the developer who had already claimed that name in official plans. The move, made quietly during a heated approval process, raises serious questions about whether Fate’s city government crossed from partner to predator, taking digital ownership of a project it was supposed to oversee with neutrality and good faith… and depriving the developer of their rights to domain ownership.

What followed, attempts to conceal the purchase, shifting explanations from city officials, and a documented pattern of advocacy on behalf of the developer, suggests the domain registration was not an accident, but part of a broader effort to control the narrative around one of the most divisive projects in the city’s history.

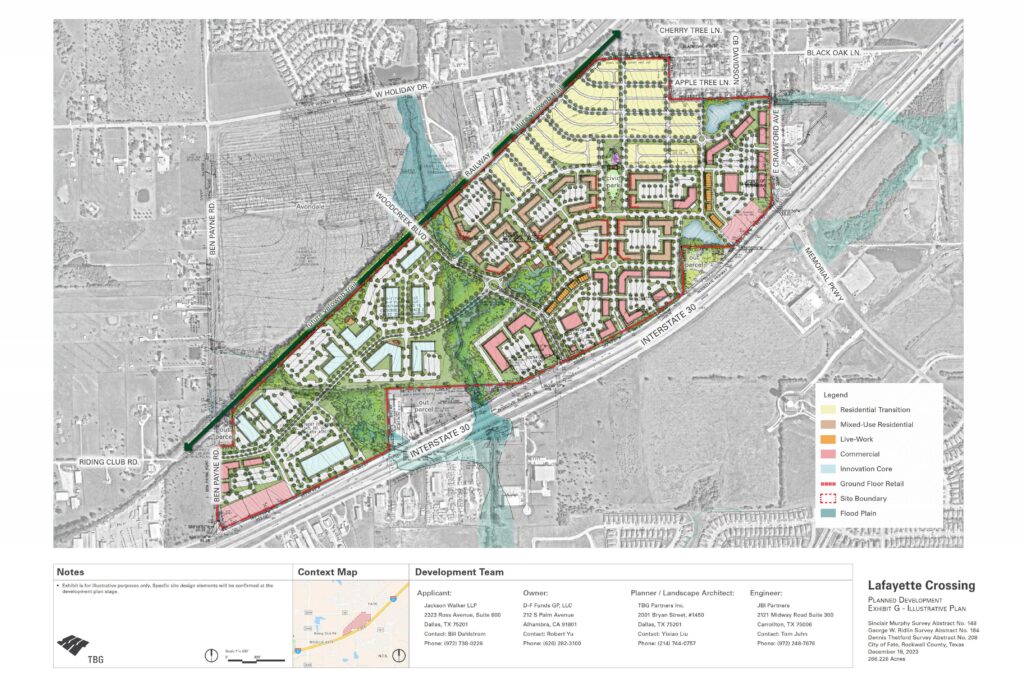

A site plan submitted by the developer, D-F Funds GP, LLC, led by Robert Yu, shows the project title “Lafayette Crossing” clearly identified in the title block on December 20, 2023. The document was part of the city’s official development review for the controversial project at the corner of I-30 and Highway 551.

Less than two months later, on February 7, 2024, the City of Fate registered the domain lafayettecrossing.com, Invoice #116953461, for $12.

Domain records confirm the registration date, with the domain set to expire on February 7, 2027. By that point, Lafayette Crossing was already the established name of the project, used by the developer and embedded in official plans circulating within City Hall.

This was not a coincidence. The city had the plans from the developer. Their were extensive talks regarding the project. Then the city registered the domain without the knowledge of the developer. This is known in the industry as, “Cybersquatting.”

The development, originally referred to as the “Yu Tract,” became known as Lafayette Crossing as it moved through the approval process. The project ignited intense public opposition over density, traffic congestion, infrastructure strain, and the long-term direction of Fate’s growth. Despite sustained resistance and packed council chambers, the city council approved the project.

The political fallout was severe. In the elections that followed, four council members and the mayor were replaced, an extraordinary level of turnover that reflected deep voter dissatisfaction. Two members from that Council, Councilman Mark Harper and Councilman Scott Kelley, remain, but are up for reelection this May.

That context matters, because the domain registration did not occur in isolation. It occurred amid a broader, documented pattern of city officials actively working to shape public perception in favor of the developer.

In February 2024, Pipkins Reports, then operating as the Fate Tribune, published an exposé based on internal city emails showing City Manager Michael Kovacs discussing strategies to “educate” the public about Lafayette Crossing. In those emails, Kovacs suggested deploying what he referred to as “Fire Support,” a term used to describe both paid and unpaid advocates brought forward to counter citizen opposition and astroturf public support for the project.

That reporting revealed a city government not merely responding to public concerns, but actively attempting to manage and counter them.

In a later publication, Pipkins Reports (Fate Tribune) documented the City of Fate’s hiring of Ryan Breckenridge of BRK Partners, engaging in what records showed to be a coordinated public relations effort aimed at improving the project’s image and swaying public sentiment. The campaign was presented as informational, but residents viewed it as advocacy on behalf of the developer, funded with public resources.

It was within this environment, where city staff had already aligned themselves publicly and privately with the developer’s interests, that the city registered the lafayettecrossing.com domain. Yet that fact remained hidden until PipkinsReports.com submitted an Open Records Request on September 30, 2025, seeking a list of all domains owned by the city.

Rather than comply, the City of Fate objected. On October 14, 2025, officials asked the Texas Attorney General’s Office for permission to withhold the records, citing “cybersecurity” concerns.

On January 6, 2026, the Attorney General rejected that claim and ordered the information released. The city complied on January 20, 2026.

In addition to the lafayettecrossing.com domain, the records revealed the city owns numerous domains tied to redevelopment and branding initiatives, including:

- FateTX.gov

- DowntownFate.com

- FateFoodHaul.com

- FateMainStreet.com

- FateStationHub.com

- FateStationMarket.com

- FateStationPark.com

- FateStationSpur.com

- OldTownFate.com

- TheHubAtFateStation.com

- TheSpurAtFateStation.com

- ForwardFate.com

Most clearly relate to city-led initiatives. LafayetteCrossing.com stands apart because it mirrors the established name of a private development already proposed, named, and publicly debated.

When questioned via email, Assistant City Manager Steven Downs initially suggested the domain purchase occurred long before his involvement and downplayed any potential issues. When we revealed documents to show Downs was actively engaged with the project at the same time the Lafayette Crossing name entered the city’s official workflow, his story changed.

In follow-up correspondence, Downs acknowledged he was aware of the project name, while placing responsibility for the domain purchase on former Assistant City Manager Justin Weiss. Downs stated he did not know whether the developer was aware of the purchase and said he was not concerned about potential liability.

What remains unexplained is why the city registered the domain at all, knowing it belonged to a private project, and why it attempted to keep that information from the public.

Opinion

Viewed in isolation, a $12 domain purchase might seem trivial. Viewed in context, it is not.

When a city that has already worked to astroturf support, hire public relations firms, and counter citizen opposition also quietly registers a developer’s project domain, then attempts to conceal that information from the public, the line between regulator and advocate disappears.

The question is no longer whether the city knew the name. The record shows it did.

The question is why a city government so deeply invested in selling a controversial project to its residents felt the need to take ownership of the project’s digital identity as well.

Control of messaging, control of perception, and control of narrative are powerful tools. Sometimes it is equally as important to control what is not said.

Council

Fate City Council Votes to Release Secret Recordings

Councilman Mark Harper walks out of meeting before adjournment.

FATE, TX – The Fate City Council voted late Monday night to waive deliberative privilege, opening the door to the public release of secret audio recordings that may have driven a recall election against Councilwoman Codi Chinn. The decision came after hours of public criticism, procedural friction, and a lengthy executive session with legal counsel.

The meeting, held Monday, February 2, was streamed live by the city and is available on YouTube at: https://www.youtube.com/live/zQVN0i-d8C0 (Embedded Below)

(Source: City of Fate, official meeting broadcast)

Timeline for Readers

- 00:33:52 – Public comments begin, largely focused on the recall election of Councilwoman Codi Chinn.

- 00:56:10 – Councilman Harper interrupts public Comment.

- 00:57:00 – Councilman Harper interrupts public Comment.

- 00:58:00 – Councilman Harper interrupts public Comment.

- 02:21:00 – Executive Session – Council enters closed session to consult with legal counsel.

- 03:22:52 – Council reconvenes in open session.

- Primary motion – Council votes to “waive deliberative privilege”, allowing release of disputed audio recordings.

Public Comment and Visible Strain

Public comments began just after the 33 minute mark and quickly centered on the recall election. Speaker after speaker questioned the conduct of city officials and demanded transparency regarding audio recordings that have circulated privately but remained unavailable to the public.

During one speaker’s remarks, critical of Councilwoman Chinn, procedural tension became visible. Three separate times, Councilman Mark Harper interrupted to remind Mayor Andrew Greenberg that the speaker had exceeded the three-minute time limit. Each time, Mayor Greenberg thanked Harper for the reminder, then directed the speaker to continue.

The exchange stood out. While council rules clearly limit speakers to three minutes, the mayor’s repeated decision to allow the speaker to proceed suggested an effort to avoid the appearance of silencing criticism during a highly charged meeting.

Clarifying the Recordings

Contrary to some early assumptions, the audio recordings at issue were not recordings of executive sessions. Instead, they are one-party consent recordings, the existence of which has been previously reported and alluded to on Pipkins Reports. Their precise origin has not been publicly detailed, but their contents have been referenced repeatedly by both supporters and critics of the recall effort.

Behind Closed Doors

Following the public meeting, the council entered executive session to consult with legal counsel. After about an hour, members returned to open session at approximately 3:22:52 .

The primary motion coming out of that session was to “waive deliberative privilege“. The effect of the vote was to remove a legal obstacle to releasing the secret audio recordings that have been at the center of the controversy.

No excerpts were played, and no conclusions were announced. The council did not rule on the legality of the recordings, nor did it weigh in on the merits of the recall election itself.

Why the Vote Matters

The decision does not resolve the recall of Councilwoman Chinn. It does not validate or refute claims made by either side. What it does is shift the debate away from rumor and secondhand accounts.

According to guidance from the Texas Municipal League, governing bodies may waive certain privileges when transparency is deemed to serve the public interest, particularly when litigation risk is balanced against public trust (Texas Municipal League, Open Meetings Act resources).

Opinion and Perspective

The council’s action was a necessary step. Secret recordings, selectively referenced and strategically leaked, undermine confidence in local government. So does a refusal to confront them directly.

Transparency is not about protecting officials from embarrassment. It is NOT the job of the council to assist the city in concealing information that may be used against it in legal proceedings when the City Manager, or Councilmen, may have done bad things. It is about protecting citizens from manipulation. If the recordings exonerate those involved, their release will restore credibility. If they raise concerns, voters deserve to hear them unfiltered before making decisions in a recall election.

Monday night in Fate did not end the controversy. It ended the excuse for keeping the public in the dark.

Election

Bob Hall Faces Old Allegations as Supporters of His Opponent Stir Controversy in Rockwall

ROCKWALL, TX — Texas State Sen. Bob Hall appeared before voters at Rockwall County’s Final Friday Night Forum, on Friday. The appearance renewed online criticism from supporters of his primary challenger which brought attention back to a decades-old allegation from a former marriage and also to social-media comments allegidily attributed to Hall’s wife.

The renewed discussion did not stem from new legal filings, court actions, or investigative reporting. Instead, it followed social-media posts by individuals publicly supporting Hall’s opponent, Jason Eddington, including Fate City Councilwoman Codi Chinn, whose sharply worded statements have drawn attention for both their substance and tone.

The Forum and the Race

The forum was hosted by Blue Ribbon News in partnership with the Rockwall County Republican Party, and held at the Rockwall County Courthouse. It marked the final event in a series intended to give Republican voters an opportunity to hear directly from candidates ahead of the March primary.

Other candidates in attendance included:

- Rockwall County Judge

- Frank New

- Scott Muckensturm

- County Commissioner, Precinct 4

- John Stacy

- James Branch

- Lorne Megyesi

- Justice of the Peace, Precinct 2

- Victor Carrillo

- Chris Florance

Pipkins Reports could find no official transcript or video of the forum. According to available coverage, the event proceeded without public discussion of personal controversies, and no candidate addressed the matter from the stage.

Background on the Allegations

The most damaging allegations currently being recirculated date back to divorce proceedings in Florida in the early 1990s, during which Hall’s former wife, Jane Hall, made claims in court filings alleging physical, verbal, and sexual abuse during their marriage.

The allegations, raised during a contested divorce, as they often do. Bob Hall has denied the allegations. No criminal charges were filed. No court ruled against Hall or issued a finding of abuse. The filings did not result in convictions, injunctions, or adverse judgments.

The allegations became publicly discussed during Hall’s first Senate campaign in 2014 and have resurfaced intermittently during contested elections. Their latest reappearance coincides with the current Republican primary and has been driven by individuals openly advocating for Hall’s opponent.

Explicit Attribution and Political Context

Following the January 30 forum, Fate City Councilwoman Codi Chinn, who has publicly endorsed Jason Eddington, posted a statement on social media criticizing Hall and urging Republican voters to support Eddington.

In her post, Chinn wrote:

“Senator Bob Hall I expect you will be making a statement issuing an apology on behalf of your wife for body shaming a woman simply because you don’t ideologically agree with her. These comments are shameful and your silence is deafening. Being Republican shouldn’t mean being small minded. I hope Republican Primary voters will pick the true Conservative Jason Eddington, Candidate for Texas Senate, District 2!”

Critics of Chinn, including some local Republican activists, say the post reflects what they describe as a pattern of caustic and confrontational rhetoric directed at individuals she opposes politically. It’s ironic that Chinn requests accountability for language of others, while she herself asks for forgiveness of her digressions in her bid to not be recalled. Supporters of Chinn, by contrast, characterize her comments as blunt advocacy and a willingness to publicly challenge those with whom she disagrees.

Amplification by a Political Social Media Page

On January 31 at 10:57 p.m., the Facebook page Rockwall County News First published a post calling on the Rockwall County Republican Party to condemn comments attributed to Hall’s wife. The page credited Codi Crimson Chinn as the source of screenshots included in the post.

The post stated:

“We hope that Rockwall County Republican Party will join us in condemning Senator Bob Hall’s wife in her comments.”

The screenshots included in the post purport to show comments written by Kay Hall, Senator Hall’s wife. The screenshots have not been independently authenticated by this publication. According to the screenshots, the comments attributed to Kay Hall read:

“Oh, yes, so disgusting to see Jill get up an speak. She and all of the TFRW little people are in their element. Wish I had recorded her speech, or even more wish I had stood up in the room to tell everyone how she got the Democrats to vote for her in the election. The pictures are very flattering to her because she has gained weight and really looked aged. I am sitting across from Bob near the podium. too, close!!!”

As of publication, neither Senator Hall nor his wife has publicly confirmed the authenticity of the screenshots or issued a statement regarding the comments.

Hall’s Position and Current Status

Hall has not publicly addressed the social-media posts and did not respond to our request for comment. He has previously stated, during earlier campaigns, that efforts to revive allegations from his former marriage are politically motivated and unrelated to any legal findings or his conduct in office.

Hall is currently married to Sarah Kay Smith Hall, with whom he has three children. There are no legal actions or criminal allegations involving his current marriage. The current controversy centers on online posts circulated by political opponents and their supporters.

Conclusion

The Final Friday Night Forum was intended to focus voter attention on policy differences among Republican candidates. In the days following the event, however, the race shifted toward personal disputes fueled by online posts from supporters of Hall’s challenger, including commentary that some observers describe as emblematic of an increasingly sharp-edged political style.

As the March primary approaches, voters in Senate District 2 must weigh not only policy and legislative records, but also the motivations and methods used by campaigns and their advocates. Whether the renewed criticism is viewed as relevant scrutiny or as opposition-driven escalation remains a question for the electorate to decide.

You must be logged in to post a comment Login