Identify Theft Rampant on Facebook – Beware of Fake Jobs

Fake job scams lead to identity theft and billions in losses to Americans.

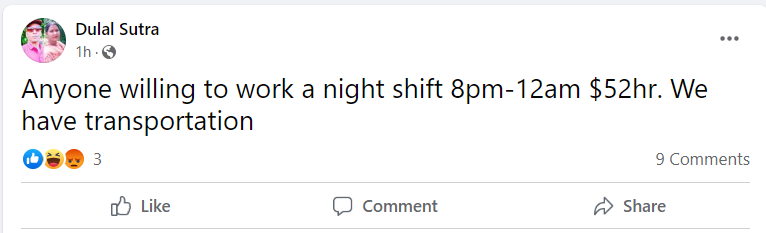

You have probably seen the job listings on Facebook recently. “Driver needed. 35 hrs per week. $100,000”. “Anyone willing to work a night shift 8pm – 12am. $52hr. We have transportation”.

In reality, there are no “late shift” or “drivers needed” jobs. These are just the latest in “Imposter Scams” tracked by the Federal Trade Commission. In just the first and second quarters of 2022, Americans have lost over $1.3 billion dollars to scammers.

According to the FBI’s Internet Crime Complaint Center (IC3), in 2020, Texas reported 1,720 victims with a reported $4.5 million in losses. There were 69 victims in El Paso totaling $721,600 in losses. In El Paso, there were eight victims reporting $31,928 in losses. Midland/Odessa reported 10 incidents in 2020 totaling $71,500. The average reported loss was nearly $3,000 per victim, in addition to the damage to the victims’ credit scores.

The examples given above outline simply the entry point of this gigantic fraud scheme that can get quite intricate and encompassing.

A link is provided to a victim either through Facebook, Linked In, email, or Instant Messenger to a very legitimate-looking Job board, employer, or recruiter website. Occasionally, they are even (very sophisticated) spoofed versions of websites such as Indeed.com.

How they get you there is really not important, what’s important is that once you are there you will need to fill out the employment application … just as in every job you have ever applied for. Once you start typing your information you are already headed into the abyss.

In no time they will have just about everything they need to steal your identity. Name, address, phone number, email address. Work history…. Those are easy and most people will give that information away freely.

If you clicked on a link from Facebook they already have your social media account and will instantly start downloading your profile pictures or anything else they might need to create a “fake” account with your name on it. With that, they will spoof your friends. But YOU will be blocked so that you can’t see what they are doing.

When it comes to that “Driver” job … well for that you will, of course, have to enter your driver’s license number … “For insurance purposes” you are told. And of course, you will have to fill out the W4 form (giving them your social security number) in order to have the proper taxes deducted from your check, of course.

Once you are on the hook no matter what happens from here on out you are already a victim … you just don’t know it yet.

In some cases, they might just ghost you from this point forward. Walking away with your information and setting you up for identity theft and stealing every dime from you. Days later you are left wondering what ever happened to that job. When you try to contact them your inquiries go unanswered.

A few of them go even further.

They tell you that you will need to pay a small processing fee for the application. Or perhaps it is a referral fee to the recruiter. It might be a fee as low as $4.99 or as high as $24.99… or more. At this point, they may have already run your credit (and stored that information for later use) and figured out how much they think they can scam you. Once you agree to pay, now they also have at least one credit card.

From here they have full reign to do just about anything they want with your identity. But the latest scam, as reported in propublica.org is one that you might not even be aware of… Unemployment Insurance Fraud.

In February 2021, the U.S. Department of Labor issued an Alert that stated that they had identified upwards of $5.4 billion in potentially fraudulent Unemployment Insurance benefits.

“A Bronx man allegedly received $1.5 million in just ten months. A California real estate broker raked in more than $500,000 within half a year. A Nigerian government official is accused of pocketing over $350,000 in less than six weeks.

What they all had in common, according to federal prosecutors, was participation in what may turn out to be the biggest fraud wave in U.S. history: filing bogus claims for unemployment insurance benefits during the COVID-19 pandemic.” writes, Cezary Podkul with Propublica.

By the time the jobless claims ended in September 2021, the U.S. Department of Labor’s inspector general estimates that at least $87 billion in fraudulent and improper payments will have been paid.

The Federal Trade Commission has stated that in 2021, “Government documents or benefits fraud” was the most prevalent type of identity theft case — more than 395,000 people reported that someone submitted a fraudulent government document under their name. This number represents a 70% spike over 2020 numbers.

So when you witness those seemingly benign Facebook posts about a “Driver needed” or “Late shift workers” be sure to not only report the post as Spam or Fraud but also block them.

The FBI recommends the following tips to protect yourself:

- Conduct a web search of the hiring company using the company name only. Results that return multiple websites for the same company (abccompany.com and abccompanyllc.com) may indicate fraudulent job listings.

- Legitimate companies will ask for PII and bank account information for payroll purposes AFTER hiring employees. This information is safer to give in-person. If in-person contact is not possible, a video call with the potential employer can confirm identity, especially if the company has a directory against which to compare employee photos.

- Never send money to someone you meet online, especially by wire transfer.

- Never provide credit card information to an employer.

- Never provide bank account information to employers without verifying their identity.

- Do not accept any job offers that ask you to use your own bank account to transfer their money. A legitimate company will not ask you to do this.

- Never share your Social Security number or other PII that can be used to access your accounts with someone who does not need to know this information.

- Before entering PII online, make sure the website is secure by looking at the address bar. The address should begin with “https://”, not “http://”.

- However: criminals can also use “https://” to give victims a false sense of security. A decision to proceed should not be based solely upon the use of “https://”.

Featured

Trump Says U.S. Used Classified “Discombobulator” to Paralyze Venezuelan Defenses

CARACAS, VENEZUELA — When President Donald J. Trump dropped the phrase “Discombobulator” in a recent interview, the world sat up and took notice. According to the president, the United States deployed a secret weapon to render Venezuelan military systems useless as U.S. forces executed a daring raid that resulted in the capture of Nicolás Maduro.

In an interview with the New York Post, Trump stated the device “made the equipment not work,” and that Venezuelan radar, missiles, and defensive systems “never got their rockets off” during the operation. “I’m not allowed to talk about it,” he said, referring to the classified nature of the technology.

The remarks have sparked curiosity, skepticism, and intense speculation about what the “Discombobulator” might actually be — and what its use means for U.S. military capability and foreign policy.

What Happened: The Maduro Raid and the Discombobulator Claim

On January 3, 2026, U.S. special operations forces carried out a rapid, highly coordinated mission in Caracas that culminated in the capture of Venezuela’s president, Nicolás Maduro, and his wife, Cilia Flores. The operation, code-named Operation Absolute Resolve, involved aircraft, helicopters, unmanned drones, and elite troops.

Speaking about the raid, Trump took credit for the success, telling the New York Post and others that a classified weapon, the so-called Discombobulator, as he called it, played a decisive role. He claimed that the device disabled Venezuelan military equipment, including systems supplied by Russia and China, before U.S. forces landed.

According to Trump’s account, Venezuelan troops tried to activate their defenses, “pressed buttons,” and found nothing worked. The president’s description suggests a form of electronic or directed-energy warfare — although he offered no detail on mechanism or development.

Context: Military Technology and Secrecy

The U.S. military has long invested in electronic warfare and directed-energy research. Systems that jam radar, disrupt communications, and interfere with electronic signals have been under development for decades. Yet no publicly acknowledged program has been confirmed to match Trump’s description of the Discombobulator.

Wartime secrecy and classification make it entirely plausible that capabilities not widely known could exist. Still, without independent verification or military documentation, journalists and analysts caution against jumping to definitive claims based on the president’s interview alone.

Conservative Commentary and Conclusion (Opinion)

The success of the Maduro raid reflects decisive leadership and a willingness to act where lesser administrations have hesitated. The Discombobulator claim — irrespective of its accuracy — underscores a broader theme: American ingenuity paired with bold strategy is unstoppable.

If such a capability exists and was responsibly employed to save lives and neutralize threats without explosive conflict, it represents a powerful demonstration of military superiority. Critics who mock the name risk missing the larger strategic point.

Whether the Discombobulator ends up in the annals of military history or remains a rhetorical flourish, the episode has already ignited fear in our adversaries about American power, innovation, and military might.

Sources:

- President Trump comments on “Discombobulator,” PBS NewsHour, Jan. 26, 2026.

- AP News reporting on Trump’s interview and weapon description.

- Gulf News analysis of unnamed weapon and its reported effects.

- Axios on use of U.S. drones and technology in operation.

- Wikipedia entry on 2026 United States intervention in Venezuela.

Business

California’s Billionaire Wealth Tax Sends Rich People Fleeing to Texas and Florida

Google Co-Founder Heads to Florida

Sacramento, CA. – A seismic shift in California’s economic landscape is quietly underway as lawmakers and union backers push a controversial billionaire wealth tax. What was pitched as a modest 5 percent levy on the ultra-wealthy has exposed more serious threats to innovation and property rights — and it has already driven one of the state’s most famous founders out of California. Google co-founder Larry Page has relocated to Florida, driven in part by provisions in the tax that could assess billions of dollars on unrealized gains tied to super-voting Class B stock.

The proposal — officially titled the 2026 Billionaire Tax Act — would impose a one-time 5 percent charge on the net worth of individuals whose worldwide assets exceed $1 billion as of January 1, 2026. Supporters frame it as a targeted revenue source for healthcare, food assistance, and education, critics warn the tax’s mechanics could reshape American capital formation.

What the Proposal Actually Does

Under the initiative, wealth is defined as total global net worth, including publicly traded stocks, private business interests, intellectual property, and other assets — excluding most real estate and certain retirement accounts. Rather than taxing only realized income, the tax includes unrealized gains in asset value. That means founders may owe tax on increases in stock value they have never sold.

The language of the proposal goes a step further: it treats voting power as though it were equivalent to economic ownership for founders with dual-class stock structures. In Silicon Valley, it is common for founders to hold Class B super-voting shares that confer control with far less economic interest than voting interest. Under the initiative’s valuation rules, a founder with 3 percent of a company’s economic shares but 30 percent voting control could be treated, for tax purposes, as owning 30 percent of the company — multiplying their taxable wealth many times over.

Economists have pointed out that this “voting power equals ownership” assumption effectively taxes phantom wealth — value that exists on paper but is not proportionate to actual economic ownership. The result: tax bills far greater than a simple 5 percent of net worth might suggest, particularly for founders of tech companies structured around dual-class stock.

Exodus of Billionaires Begins

The reaction among California’s wealthy has been dramatic. Larry Page, whose super-voting Class B shares give him outsized control at Alphabet, has purchased multiple high-value properties in Florida and moved many business entities out of California. His relocation comes amid widespread concerns that the wealth tax could penalize founders disproportionately based on voting shares rather than actual economic stake.

Venture capitalist Peter Thiel has also publicly mobilized against the tax, donating millions to efforts to defeat it and shifting aspects of his business operations to Miami. Other tech leaders and investors are reconsidering their California footprint, with some establishing offices or residences in states like Texas or Florida.

Economic and Legal Concerns

Economists and legal scholars caution that enforcing a tax on unrealized gains is inherently complex. Valuing privately held assets and dual-class stock structures invites disputes and litigation. The retroactive assessment based on residency at a fixed date could expose residents to significant tax bills even if they had intended to leave the state before the tax was implemented.

Critics also argue that using voting power as a proxy for economic value could violate constitutional protections against uncompensated takings, as it effectively treats control rights — not purely economic interest — as taxable property. Legal challenges are almost certain if the measure qualifies for the ballot and is approved by voters.

Political Clash

Supporters, including union leaders and some progressive advocates, say the tax would help fill budget gaps in healthcare and social services created by federal spending cuts. They maintain that the ultra-wealthy have benefited disproportionately from California’s economy and should contribute more.

Governor Gavin Newsom (D), has distanced himself from the proposal, warning that it threatens investment and could accelerate capital flight. Business groups such as the California Chamber of Commerce and the California Business Roundtable have echoed those warnings, describing the tax as a “dangerous wealth tax” that could harm the state’s competitiveness.

Broader Implications

California’s billionaire tax debate has quickly transcended local politics to become a national test case. If approved by voters in November 2026, it could encourage similar initiatives elsewhere, particularly in high-tax states. At the same time, the backlash has highlighted the risks of taxing unrealized gains — a feature that economists and tax policy experts say is untested and could disrupt capital formation.

For states like Texas and Florida, which champion low taxes and economic freedom, California’s experiment presents both a contrast and an opportunity. As capital and executives reassess their domiciles, the business climate and economic growth of states without such wealth taxes may benefit.

Larry Page’s move to Florida is not just a personal choice. It is a symbolic indicator of where capital flows in response to policy. Once talent and wealth leave, they seldom return. California’s experiment in wealth taxation should give pause not only to its voters but to every state considering similar schemes.

Sources:

Tax Foundation, “The Proposed California Wealth Tax Is Far Higher than 5 Percent,” January 2026.

California Attorney General Initiative Text, “2026 Billionaire Tax Act.”

Business Insider, “Larry Page Continues His California Exile with Florida Property Purchases,” January 2026.

Yahoo Finance, “Peter Thiel’s $3 Million Donation to Defeat California Wealth Tax,” January 2026.

WebProNews, “Dual-Class Voting Share Valuation Sparks Silicon Valley Outrage,” January 2026.

Featured

A.I. Writes the News

It happened without a press release, a ribbon cutting, or a newsroom meeting. No editors gathered around a conference table. No overnight rewrite battles. Yet today, a functioning newsroom is live and publishing verified news automatically—at ai.pipkinsreports.com, and it runs almost entirely without human hands.

Pipkins Reports has launched a new artificial intelligence–driven subdomain that operates as a self-contained newsroom. Built using a custom API written end-to-end by Grok A.I., the system is designed to identify assigned topics, locate relevant articles across the web, independently research and verify claims using multiple sources, generate headlines and full-length stories, source appropriate public-domain imagery, and publish finished articles … automatically.

In short, the machine does what an entire entry-level newsroom used to do. Without taking lunch breaks, demanding bylines, or injecting ideology on command.

The project was quietly developed over several weeks and went live on December 7th. Unlike many “AI-assisted” publishing platforms that rely heavily on human prompts and editorial cleanup, this system was intentionally designed to minimize human involvement. Editors define subject lanes and guardrails … the AI handles the rest.

The technical foundation is notable. Using Grok A.I. as the development engine, Pipkins Reports built a custom application programming interface that wrote its own backend logic, frontend display framework, content pipeline, and publishing automation. The system does not simply summarize articles. It searches for original reporting, confirms factual claims through additional sourcing, and rejects content where corroboration fails.

Verification, long the Achilles’ heel of automated content, was treated as a primary design constraint. The system cross-references claims using multiple independent outlets and open-source databases before proceeding. When verification thresholds are not met, articles are abandoned rather than published.

This matters. In an era where major legacy outlets routinely rush half-formed narratives into print, a machine programmed to stop when facts are thin presents an uncomfortable contrast.

Images are sourced exclusively from public-domain repositories. Headlines are generated based on relevance and reader clarity, with just a hint of sensationalism to grab readers attention. Articles are structured using standard journalistic conventions—the who, what, when, where, and how—without stylistic quirks designed to provoke outrage or favor partisan framing.

That does not mean the system is “neutral” in the dishonest, modern sense of the word. Topics are chosen intentionally by Pipkins Reports. A conservative voice is intentionally programmed into the prose. The editorial philosophy remains constitutionally conservative. What changes is the mechanism of production.

The implications extend beyond Pipkins Reports.

For decades, journalism’s gatekeepers insisted that large institutional newsrooms were necessary to safeguard democracy. The cost structure of that model collapsed long ago, replaced by donor-funded nonprofits and corporate-sponsored “journalism” that routinely blurs activism with reporting. Trust eroded accordingly.

An automated newsroom challenges that monopoly. It lowers barriers to entry while maintaining discipline. It forces a hard question: if a machine can research, verify, write, and publish responsibly, what exactly are bloated editorial staffs producing besides narrative reinforcement?

Critics will argue—fairly—that no AI system can replace human judgment. That is true. What it can replace is the excessive labor that once justified sprawling newsrooms but now masks ideological coordination. The AI newsroom does not attend off-the-record briefings. It does not cultivate access. It does not fear losing passes, grants, or invitations.

That absence of social pressure may prove to be its most valuable feature.

There are risks. Automation can scale errors as quickly as truths. Systems must be continuously audited. Human editors remain necessary—not as writers, but as governors. Pipkins Reports retains final kill-switch authority. Articles can be paused, reviewed, or removed. Editorial direction remains a human responsibility.

Yet the early results are difficult to ignore. Stories are clean. Claims are sourced. Language is readable. The machine does not editorialize unless instructed. It does not chase clicks with hysteria.

That, perhaps, is the most indictment of modern journalism. When an artificial system trained to follow rules produces straighter news than institutions staffed by credentialed professionals, the problem is no longer technology.

From a conservative perspective, this development matters deeply. The press has not failed because Americans stopped caring about truth. It failed because incentives rewarded narrative conformity over accuracy. AI, paradoxically, may strip away those incentives—if controlled by publishers who still care about verification and scope limits.

Pipkins Reports did not build an AI newsroom to replace journalists. It built one to expose how unnecessary much of the modern journalistic infrastructure has become.

The future of news may not belong to the loudest voice in the room—but to the system disciplined enough to say, “This cannot yet be proven,” and publish nothing at all.

You must be logged in to post a comment Login