Texan Justice Prevails: 8 Republican Lawmakers Key in Expelling Rep. Santos

George Santos Becomes Sixth Member Ever to be Expelled

Eight Texas Republicans in the U.S. House of Representatives played a pivotal role in the expulsion of Representative George Santos (R) from New York’s 3rd District. The move came as a response to Santos’ egregious violations, marking only the sixth expulsion in the history of the House.

The Resolution, H.Res.878, was championed by a bipartisan effort to hold Santos accountable for his actions, as detailed in a damning report from the House ethics committee. The document outlined numerous violations, including falsely reported loans, improper loan repayments, systemic reporting errors, and the conversion of campaign funds to personal use.

The eight Texas Republicans who cast their votes in favor of expulsion are:

- Burgess – 26th District, Flower Mound, Little Elm, Gainsville.

- Crenshaw – 2nd District, Woodlands, Sheldon.

- De La Cruz – 15th District, Stockdale, Corpus Christi.

- Ellzey – 6th District, Waxahachie, Corsicana.

- Tony Gonzales – 23rd District, Uvalde, Fort Stockton.

- Granger – 12th District, Fort Worth, Weatherford.

- Moran – 1st District, Longview, Tyler.

- Pfluger – 11th District, Opessa, San Angelo.

The total vote of the House to expel reached 311 in favor and 114 against, with all but two Democrats supporting the expulsion. Two Democrats voted present, and three did not vote. Astonishingly, 112 Republicans voted against expulsion, reflecting the gravity of the decision.

Representative Santos, who pleaded not guilty to 23 federal fraud charges, was charged in Federal court with wire fraud, unlawful monetary transactions, theft of public money, and false statements related to a fraudulent political contribution scheme. A superseding indictment filed on October 10, 2023, brought additional charges, including falsifying FEC reports, engaging in identity theft, and fraudulent contribution schemes.

The expulsion attempt faced challenges earlier when members of Santos’ own party attempted to oust him, but senior Democrats voted against it, emphasizing the importance of securing convictions before expulsion. However, the tide turned with the release of the House ethics committee report, which detailed the extensive misuse of campaign funds for personal gains.

New York’s 3rd District, previously held by Democrat Tom Suozzi, is a swing district that has alternated between Democrats and Republicans. Santos’ expulsion leaves the district in a state of political flux, highlighting the critical role of ethical governance in maintaining public trust.

As the nation watches this historic moment, it serves as a reminder of the House’s commitment to upholding its constitutional duty and maintaining the integrity of the democratic process.

Council

Snowstorm Showdown: Fate Recall Vote Advances as Councilwoman Chinn Accuses Mayor of Endangering Public Safety

Fate, Texas — A routine procedural vote to advance a recall election against Fate City Councilwoman Codi Chinn has escalated into a sharp political confrontation, as Chinn and her supporters accuse Mayor Andrew Greenberg of disregarding safety concerns and acting out of what they describe as personal animus.

The meeting, scheduled for Monday, January 26th, 2026, includes consideration of a Certificate of Sufficiency necessary to formally set the recall election, which has become the latest flashpoint in an increasingly bitter feud between Chinn and the mayor. Her supporters now argue the recall effort is driven by personal grievances rather than civic concerns, and some have begun openly discussing the possibility of filing a counter-recall against the mayor himself.

At issue is a recall petition that gathered more than 400 signatures from Fate residents seeking to remove Chinn from office. According to city verification records, 396 of those signatures were deemed valid—more than enough to meet the statutory threshold required to place the recall on the ballot.

Chinn and her allies do not dispute the number of verified signatures. Instead, they argue that the process, and the timing of the meeting to advance it, reflects political hostility rather than concern for good governance.

“He’s Willing to Put Ppl in Danger”

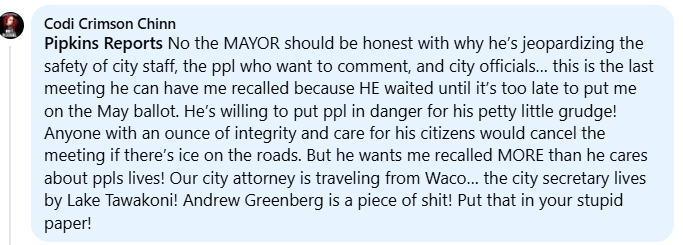

COUNCILWOMAN CODY CHINN REGARDING MAYOR GREENBERG.

In a Facebook post, Chinn accused the mayor of recklessly jeopardizing public safety in order to ensure the recall vote moved forward before key election deadlines expired. Chinn created a poll on Facebook, asking social media whether the meeting should be canceled due to weather. However, critics note that Chinn did not reference the recall timeline when raising concerns about the weather.

When Pipkins Reports asked her, “You should be honest with people and tell them why you want this.” Chinn responded:

“No the MAYOR should be honest with why he’s jeopardizing the safety of city staff, the ppl who want to comment, and city officials,” Chinn wrote. “This is the last meeting he can have me recalled because HE waited until it’s too late to put me on the May ballot.”

She continued by asserting that the mayor’s motivations were personal rather than procedural.

“He’s willing to put ppl in danger for his petty little grudge!” she wrote.

Chinn further argued that any leader genuinely concerned about residents would have postponed the meeting if road conditions deteriorated.

“Anyone with an ounce of integrity and care for his citizens would cancel the meeting if there’s ice on the roads,” she wrote. “But he wants me recalled MORE than he cares about ppls lives!”

Her post also highlighted the travel required of city staff and officials, underscoring her claim that the meeting posed unnecessary risk. In doing so, she exposed the hometown of the City Secretary. Her message concluded with profanity directed at the mayor and a disparaging remark about this publication.

A Recall Driven by Conduct, Not Weather

While Chinn and her supporters frame her as a victim and the recall as retaliation for her political positions, the general basis for the recall effort centers largely on her conduct and language while serving on the council. Critics of Chinn cite what they describe as a confrontational style and the use of sharp language during her tenure, which is incompatible with the decorum expected of an elected official. Supporters of the recall argue that her latest post reinforces their concerns.

Supporters of the recall argue that the very Facebook post Chinn used to denounce the mayor illustrates the problem voters are seeking to address. They contend the recall is not about silencing dissent, but about restoring professionalism and civility to city government.

Chinn, however, rejects that characterization, maintaining that her blunt language is being weaponized against her by political opponents unwilling to tolerate her criticism.

The Procedural Flashpoint

The City Council meeting at the center of the controversy was not the recall election itself, but a legally required step to advance it. Under Texas law, once a recall petition is certified as sufficient, the governing body must issue a certificate of sufficiency, triggering the scheduling of the election. It’s a process that must go forward … by law.

Chinn is correct about the timing. With the May election approaching, failure to act now would likely have pushed the recall into the November election, or potentially a standalone Special Election, increasing costs to the taxpayers.

Mayor Greenberg has issued the following statement on Facebook:

Supporters Escalate the Fight

As the recall process moves forward, Chinn’s supporters are signaling they are not content to play defense. Several have openly discussed the possibility of initiating a counter-recall against Mayor Greenberg, arguing that his decision to proceed with the meeting demonstrates poor judgment and disregard for public safety.

While no counter-recall petition has yet been filed, the threat alone marks a significant escalation in Fate’s already volatile political climate. What began as a recall of one council member now risks expanding into a broader referendum on the city’s leadership.

What Comes Next

If the Certificate of Sufficiency is finalized Monday night, voters will ultimately decide whether Chinn’s conduct warrants removal from office. The recall election would give residents the opportunity to weigh her style, language, and performance against her claims of political persecution.

Should her supporters follow through on threats of a counter-recall, Fate could soon find itself mired in overlapping recall efforts.

Even as weather conditions improve, tensions surrounding the recall remain unresolved. As the recall advances, the question before Fate voters is no longer simply whether Councilwoman Chinn should remain on the council, but whether the standards of conduct at City Hall have reached a breaking point.

Editor’s Note:

This article includes direct quotations from social media posts and statements made by public officials regarding an ongoing recall process. Allegations, interpretations, and characterizations attributed to elected officials or their supporters are presented as claims and opinions, not findings of fact. Pipkins Reports relies on public records, verified statements, and publicly available posts in its reporting. Readers are encouraged to review source materials and attend public meetings to form their own conclusions.

Featured

Clintons in Contempt

WASHINGTON, DC — The Clinton political machine, long accustomed to dictating the terms of engagement, ran headlong this week into an institution that does not negotiate its constitutional authority. In a rare and politically explosive move, the House Committee on Oversight and Government Reform voted on a bipartisan basis to advance contempt of Congress resolutions against former President Bill Clinton and former Secretary of State Hillary Clinton for defying lawful subpoenas tied to the Jeffrey Epstein investigation.

The January 21 vote clears the way for the full House to consider whether to formally hold the Clintons in contempt, a step that could result in criminal referrals to the Department of Justice. While neither Clinton has been accused of a crime related to Epstein, lawmakers framed the issue more narrowly and more starkly: whether elite political figures are subject to the same compulsory process as everyone else when Congress demands sworn testimony.

The subpoenas arise from Congress’s ongoing investigation into how Epstein operated a vast international sex trafficking network for years while avoiding meaningful accountability. Epstein allegedly died by suicide in a New York jail in 2019 as he awaited trial, but subsequent court filings and document releases revealed his deep and troubling access to political, financial, and cultural power centers. Bill Clinton, and numerous other influential figures appear in those records.

Oversight Committee Chairman James Comer, R-Ky., said the subpoenas issued to the Clintons were approved unanimously last summer by Republicans and Democrats alike. Bill Clinton’s deposition was initially scheduled for October 14, 2025, then moved to December 17, and later reset for January 13, 2026. Hillary Clinton followed a similar trajectory, declining multiple proposed dates before failing to appear for a January 14 deposition. In each instance, the committee said it offered flexibility if the Clintons would propose firm alternative dates. They did not.

Instead, the Clintons’ attorneys countered with what Comer described as an unacceptable proposal. Under that offer, Comer would travel to New York to speak with Bill Clinton alone, without placing him under oath, without producing an official transcript, and without allowing other members of Congress to participate. Comer rejected the proposal, arguing that it amounted to special treatment unavailable to any other witness.

“Subpoenas are not mere suggestions,” Comer said during the hearing. “They carry the force of law and require compliance.”

The committee emphasized that sworn, transcribed testimony is essential to transparency and accountability. Oversight investigators have already released transcripts of interviews with former Attorney General Bill Barr and former Labor Secretary Alex Acosta, both of whom had direct dealings with Epstein during earlier stages of his prosecution. Allowing the Clintons to substitute informal conversations or written statements, Comer argued, would erode the integrity of the investigation and leave the public dependent on competing recollections rather than a fixed record.

Democrats on the committee were divided. Some argued the subpoenas lacked a legitimate legislative purpose, while others conceded that Congress cannot selectively enforce its authority based on party loyalty. Rep. Robert Garcia of California said no current or former president should be categorically immune from oversight. Several Democrats stressed that full transparency in the Epstein case demands uniform standards, even when politically inconvenient.

Recent history undercuts claims that contempt powers are merely symbolic. Steve Bannon, former Trump campaign and White House strategist, was convicted in 2022 of contempt of Congress after defying a subpoena from the House January 6 committee. Peter Navarro, another former Trump White House adviser, was likewise charged and later imprisoned after refusing to provide testimony to the same panel. Both cases demonstrated that contempt citations can and do result in criminal penalties, including incarceration.

The Clintons have argued through counsel that the subpoenas are invalid and that they possess little relevant information. In a letter to the committee, they described Epstein’s crimes as “horrific” and said they had cooperated in good faith by offering written declarations outlining their limited interactions with him. The committee rejected that approach, noting that Hillary Clinton’s tenure as secretary of state gives her direct knowledge of federal anti trafficking initiatives and that both Clintons maintained documented personal and social ties to Epstein and his associate Ghislaine Maxwell.

Historically, contempt of Congress has been used sparingly, particularly against high profile political figures. No former president has ever been successfully compelled to testify before Congress. However, legal analysts note that the Clintons are private citizens and cannot claim executive privilege protections that might apply to a sitting president.

The contempt resolutions now move to the full House, where passage will require a majority vote. Even if approved, the Justice Department retains discretion over whether to pursue prosecution. That uncertainty has not dampened the broader significance of the moment.

At its core, the dispute is not about partisan score settling or retroactive guilt. It is about whether Congress’s investigative power means what the Constitution says it means. For decades, the Clintons operated within a political ecosystem that treated them as exceptions. The Oversight Committee’s vote suggests that era may be ending.

If subpoenas bind only the unfavored and the powerless, they bind no one at all. The House must now decide whether the rule of law applies equally, even when the names on the subpoena are Clinton.

Featured

Epstein Files Transparency Act – Is it all a PsyOp?

Washington’s ‘Epstein Transparency’ Blitz Smells Like Stagecraft—And the Perfect Setup for a Political Ambush

Opinion – Washington hasn’t moved this fast in years. In a stunning, hyper-coordinated sprint, Congress has shoved the Epstein Files Transparency Act through both chambers, while legacy media outlets blast the airwaves with breathless claims that the truth is finally, finally, on the verge of being exposed.

Yet no new documents have surfaced. Not one page. Not one fresh revelation. What the country has been given instead is a meticulously synchronized political drama that looks less like a search for accountability and more like a primed trap. With U.S. Attorney General Pam Bondi stating outright that there is “nothing to see” in the documents beyond Epstein being a disgusting predator (something the entire world already knew), the stage for a setup is nearly complete: pump the country full of hype, let the public expect a bombshell, then blame President Trump when the files don’t deliver the fantasy.

Congress Moves in Hours—After Years of Shrugs

The sudden urgency is as suspicious as it is convenient. On November 19, 2025, the Senate passed H.R. 4405 by unanimous consent—no debate, no amendments, no hesitation. This followed a 427–1 vote in the House the day before, a result NBC News framed as an inspiring moment of unity. Reuters reported that Trump’s administration even tried to slow the bill down, but congressional leaders bulldozed ahead, insisting on immediate transparency.

But despite the frantic headlines, nothing actually changed. USA Today confirmed that no documents have been unsealed. None have been newly reviewed. The “breakthrough” celebrated across legacy media is procedural—not substantive.

This quick-trigger urgency didn’t exist when the Biden administration was in charge, despite victims publicly pleading for years for a full release. Nor did it exist when the FBI circulated a July 2025 memo debunking viral claims about “elite lists”—a memo major networks largely ignored.

And yet now, following the chaos of a government shutdown, the Epstein files have suddenly become Washington’s highest priority.

A Timing Pattern Too Perfect to Ignore

Using the NCI Engineered Reality Scoring System, (a behavioral training organization specializing in “neuro-cognitive intelligence,” profiling, and influence, mainly for Government operatives), Pipkins Reports conducted an independent reassessment of the media coverage and congressional behavior. The timing element scored a perfect 5 out of 5, concluding that the alignment of political stress, media coordination, and procedural acceleration is textbook perception-shaping.

Notably, the Senate’s rush gives Trump no time to shape terms, negotiate redaction standards, or challenge questionable procedural shortcuts. The entire narrative is framed as:

Sign immediately, or you’re covering for pedophiles.

That is not oversight.

It is coerced messaging.

Choreographed Messaging—and a Public Being Led by the Nose

Across NBC, CNN, ABC, NYT, BBC, and others, the coverage has been stunningly uniform. Every outlet invoked the same two phrases—“historic transparency” and “ending the cover-up”—a level of synchronicity that Pipkins Reports rated a 5 out of 5 under the “uniform messaging” category of NCI.

When media language becomes indistinguishable between outlets, it’s rarely organic. It’s orchestrated.

Meanwhile, networks looped emotional footage of victims, recycled Epstein’s crimes, and hyped the idea that hidden secrets would soon burst into daylight. Yet, as the Pipkins Reports NCI analysis notes, not a single outlet has presented new evidence, new witnesses, new investigative paths, or new legal action.

Instead of information, Americans are being fed anticipation.

Bondi’s Warning—and the Setup No One Wants to Say Out Loud

Here is the critical piece the national press avoids:

Pam Bondi, who has reviewed the material, stated plainly that there is nothing explosive in the documents—no global conspiracy list, no massive political scandal, no secret ring of elites waiting to be exposed. The files will simply confirm what the public already knows: Epstein was a predatory degenerate.

That’s all.

Yet for the last 48 hours, the media has pumped the country full of hype promising an epoch-defining revelation. If the institutions driving this frenzy already know the files are anticlimactic—and Bondi strongly indicates they do—then this is not transparency.

It is the construction of a pre-blame narrative.

The Coming Turn: “Trump Covered It Up”

When the documents ultimately disappoint, the backlash will be ferocious. The same outlets proclaiming “historic transparency” today will pivot into accusing President Trump of redacting or burying the truth. Members of Congress—who have known all along that there’s no bombshell inside—will claim Trump sabotaged their bipartisan triumph.

The setup writes itself:

- Inflate public expectations.

- Release dull documents.

- Redirect the public’s anger toward Trump.

This is why the story was timed for now and not last year. This is why every network is using the same language. This is why critics of the process are framed not as skeptics but as obstructionists. The backlash is pre-scripted. The villain has already been cast.

Political Bandwagoning—And Washington’s Multi-Sided Win

The Pipkins Reports NCI breakdown scored “political and financial gain” another 5 out of 5, and the incentives are transparent:

- Congress gets a rare moment of unity.

- Media outlets enjoy a ratings bonanza.

- Advocacy groups prep fundraising campaigns.

- Trump’s opponents gain a future attack line.

- Bureaucrats maintain control by managing expectations, not truth.

And through it all, victims remain a footnote. They could have told their stories at any time. They could have released names themselves … but they haven’t. Why?

Of the 20 questions outlined in the NCI, this Epstein Propaganda Narrative scored 87/100 points. Indicating the media reports and narrative surrounding the Epstein documents release show overwhelming signs of a psyop. This engineered spectacle—marked by synchronized urgency, tribal framing, and selective emotional amplification—prioritizes political maneuvering and division over genuine accountability. The rapid procedural wins today, despite years of inertia, suggest controlled release to manage perceptions during the upcoming mid-term elections, benefiting Democrats, while victims’ full stories remain sidelined.

A Conservative Verdict: This Isn’t Transparency—It’s Narrative Warfare

The Epstein story deserved an authentic reckoning. Instead, the country is being marched into a political theater production choreographed by institutions desperate to protect themselves and weaponize public expectation.

If Bondi is correct—and everything indicates she is—the file release will generate no new accountability for the elite. The real explosion will come afterward, when the media and political class surge forward with the accusation they have spent days priming:

“Trump covered it up. He is guilty and is a pedophile.” … that’s the narrative they are preparing to spin and priming you to believe it.

If Americans don’t recognize the setup now, they will recognize it too late. Washington isn’t preparing the country for truth, it’s preparing the country to Blame Trump. And unless the public steps back and examines the choreography behind this supposed “transparency,” the trap will snap shut exactly as designed.

You must be logged in to post a comment Login